- A new proposal to launch Aave V3 on Ethereum has been published.

- The decline in new users on Aave has caused its daily revenue to decline by over 70% in the last year.

Aave, the decentralized lending protocol, recently put forward a proposal titled “Aave Ethereum V3,” in which it requested votes from its community members for the activation of the Aave V3 Ethereum pool (3.0.1).

Read Aave’s [AAVE] Price Prediction 2023-2024

According to the proposal, once the initial setup is completed, the pool will list pre-approved tokens such as WBTC, WETH, wstETH, USDC, DAI, LINK, and AAVE.

Although Aave V3 was launched and functional on various blockchain networks, such as Avalanche, Optimism, Polygon, Arbitrum, Fantom, and Harmony, the Ethereum pool was still using the older version V2.

However, in October 2022, community members voted and approved a proposal to implement a new V3 upgrade on the Ethereum network instead of upgrading the V2 pool.

State of Aave

According to data from DefiLlama, Aave v2 ranked fourth in terms of total value locked (TVL) with $4.1 billion, following Lido Finance, MakerDAO, and Curve. So far this year, the protocol’s TVL has risen by 28%.

While Aave V3 is functional on six chains, Aave V2 only exists on Ethereum, Avalanche, and Polygon. As of this writing, Aave’s V3 stood at $525.96 million.

Per DefiLlama, most of the activity within the Aave ecosystem takes place on its V2 deployment on the Ethereum network. 93% of the total assets locked on Aave v2, which is $4.1 billion, are on the Ethereum blockchain deployment.

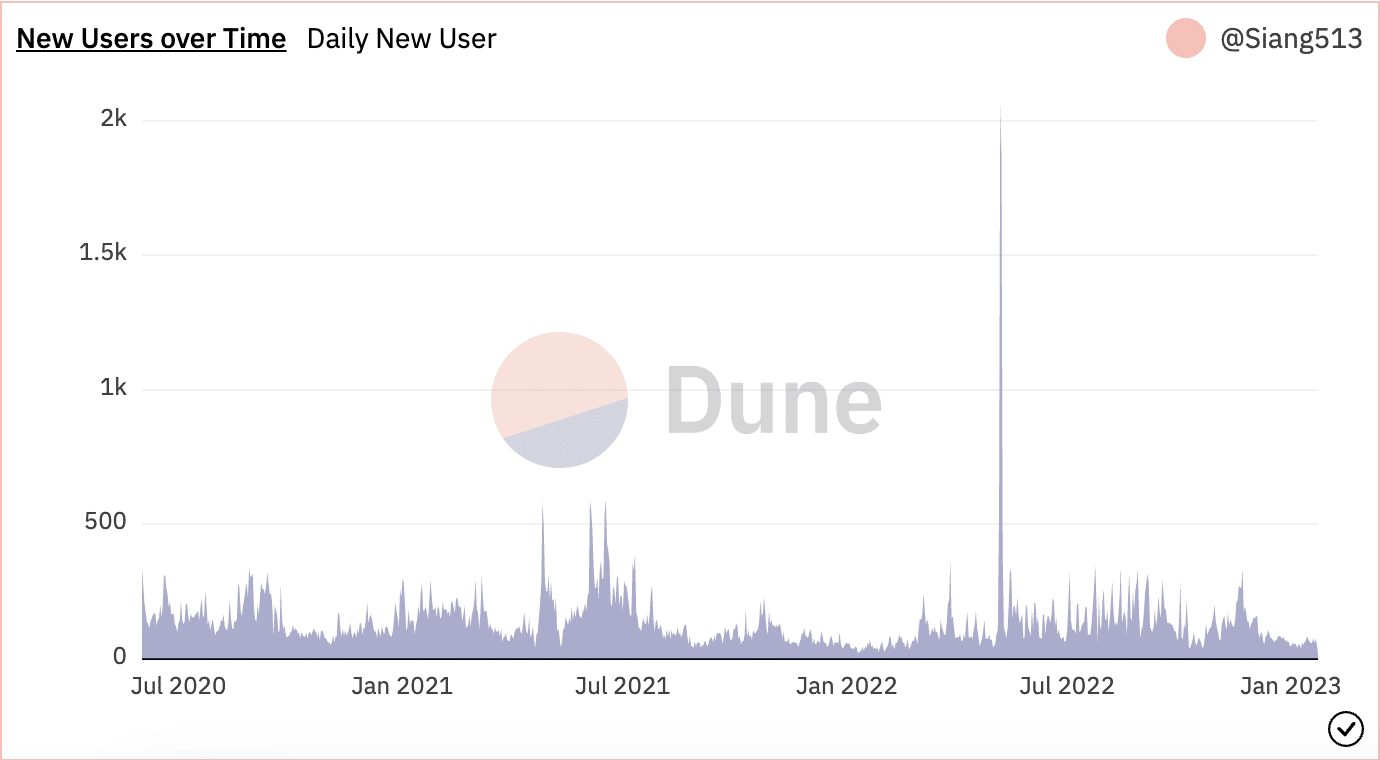

A look at user activity on the lending protocol revealed a steady decline in the count of daily new users since May 2022. Per data from Dune Analytics, the count of daily new unique users on Aave has since fallen by 96%.

How much are 1,10,100 AAVEs worth today?

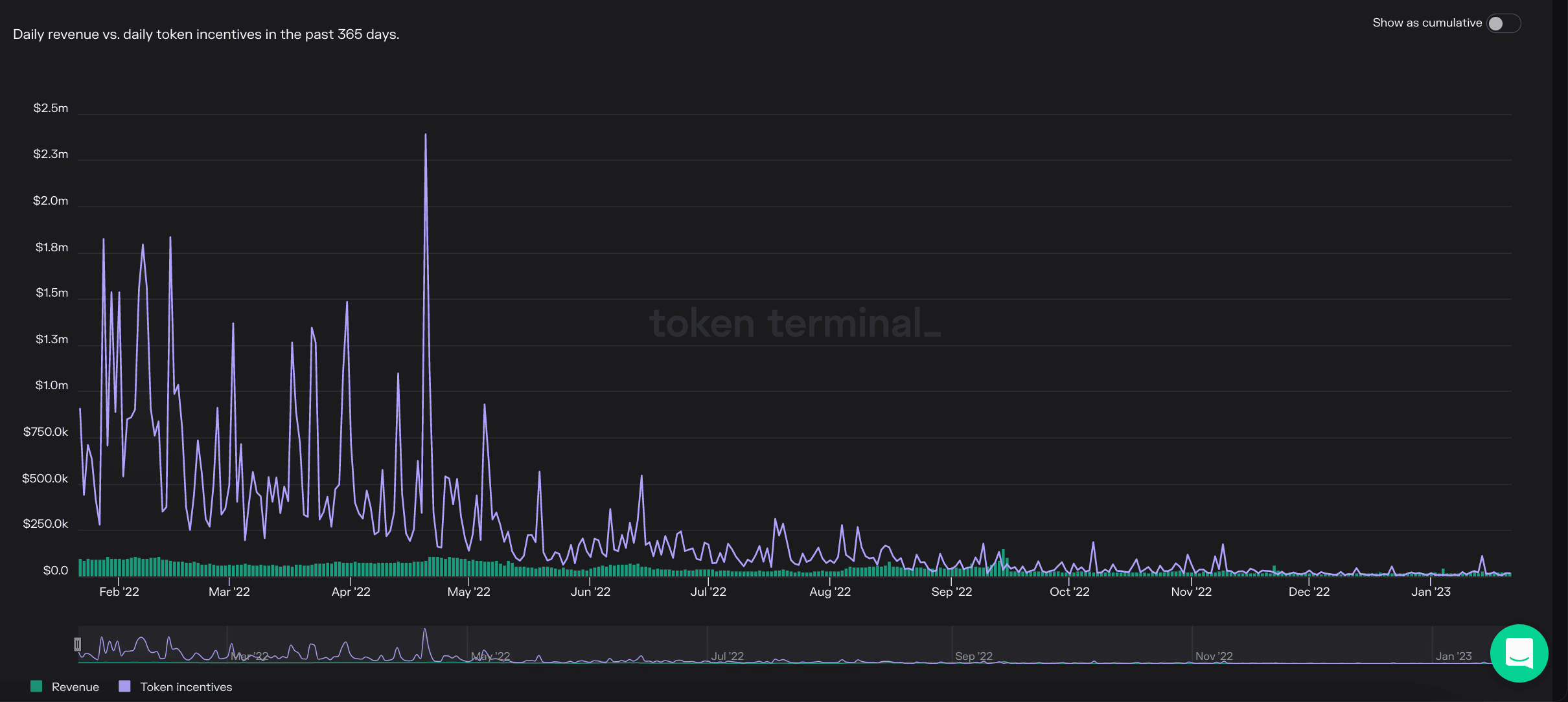

The drop in new users on Aave is attributable to the steady decline in token incentives offered by the lending platform. Token incentives are rewards or bonuses given to users who hold and use the AAVE token. Some examples of token incentives offered by Aave include interest rate discounts on loans, reduced withdrawal fees, and the ability to earn additional interest on deposited assets.

Data from Token Terminal showed that token incentives on the lending protocol had seen a significant decrease of 98% in the last year, making the platform less attractive to many users.

Finally, due to a decrease in the number of unique users visiting Aave, the daily revenue generated by the protocol has suffered a dip over the last year. Per Token Terminal, daily revenue on Aave has fallen by 76% in the past 365 days.

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Polkadot

Polkadot  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Litecoin

Litecoin  Hedera

Hedera  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Bittensor

Bittensor  Ethena USDe

Ethena USDe  Render

Render  Filecoin

Filecoin  Algorand

Algorand  Arbitrum

Arbitrum  Dai

Dai  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Immutable

Immutable  WhiteBIT Coin

WhiteBIT Coin  Celestia

Celestia