The Ethereum (ETH) Shanghai upgrade is due to release March, enabling withdrawals from beacon chain and allowing ETH currently staked in ETH 2.0 validators to be unstaked.

With over 70% of ETH stakers currently at a loss with their ETH inaccessible, the Shanghai upgrade will enable stakers access to their ETH and decide whether to sell at a loss or hold long-term until back in profit.

Post-ETH merge

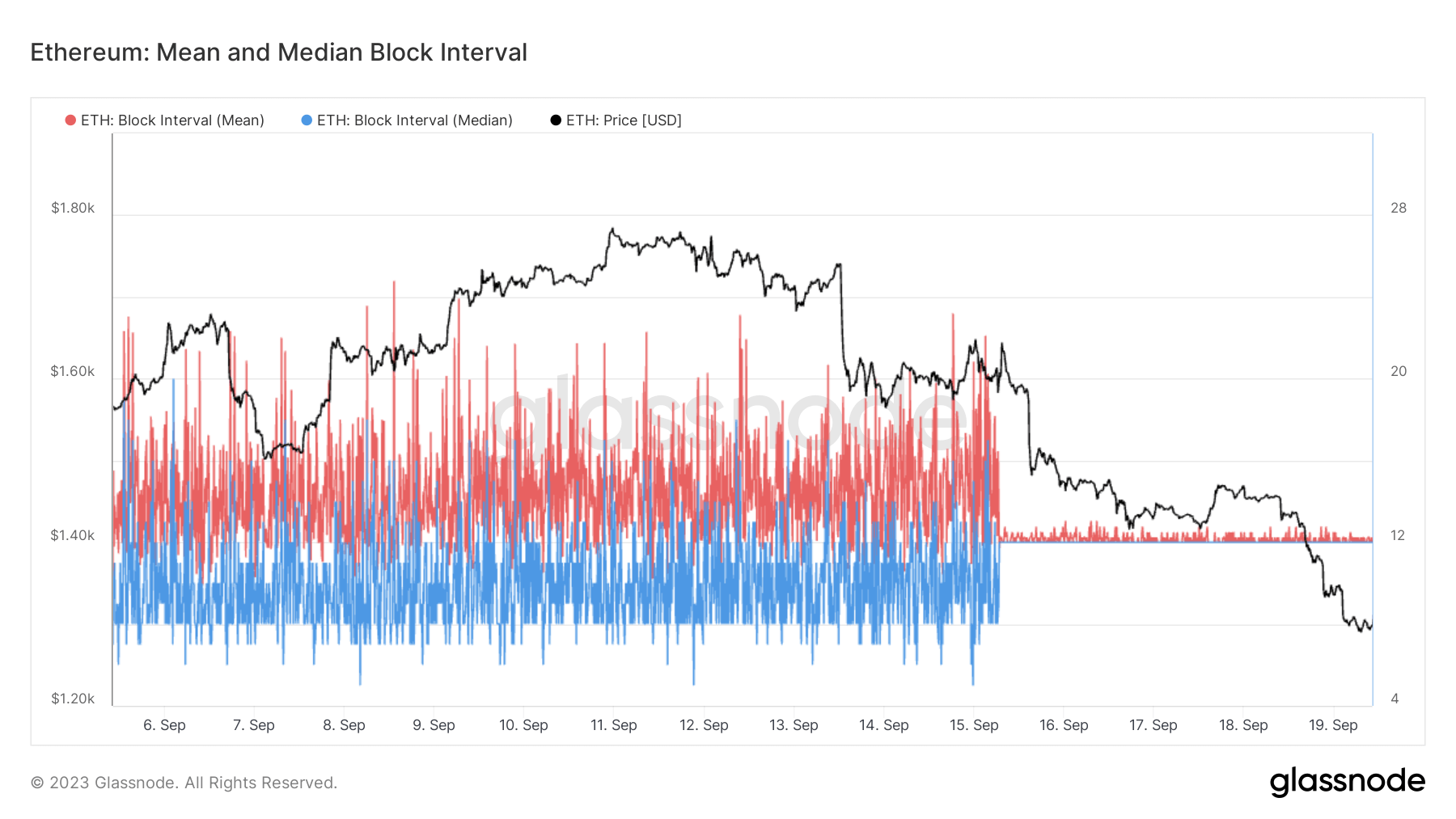

Back in September 2022, the ETH merge took place in the Bellatrix upgrade. In the process, block validation was taken over by the beacon chain completing the transition from Proof of Work (POW) to Proof of Stake (POS).

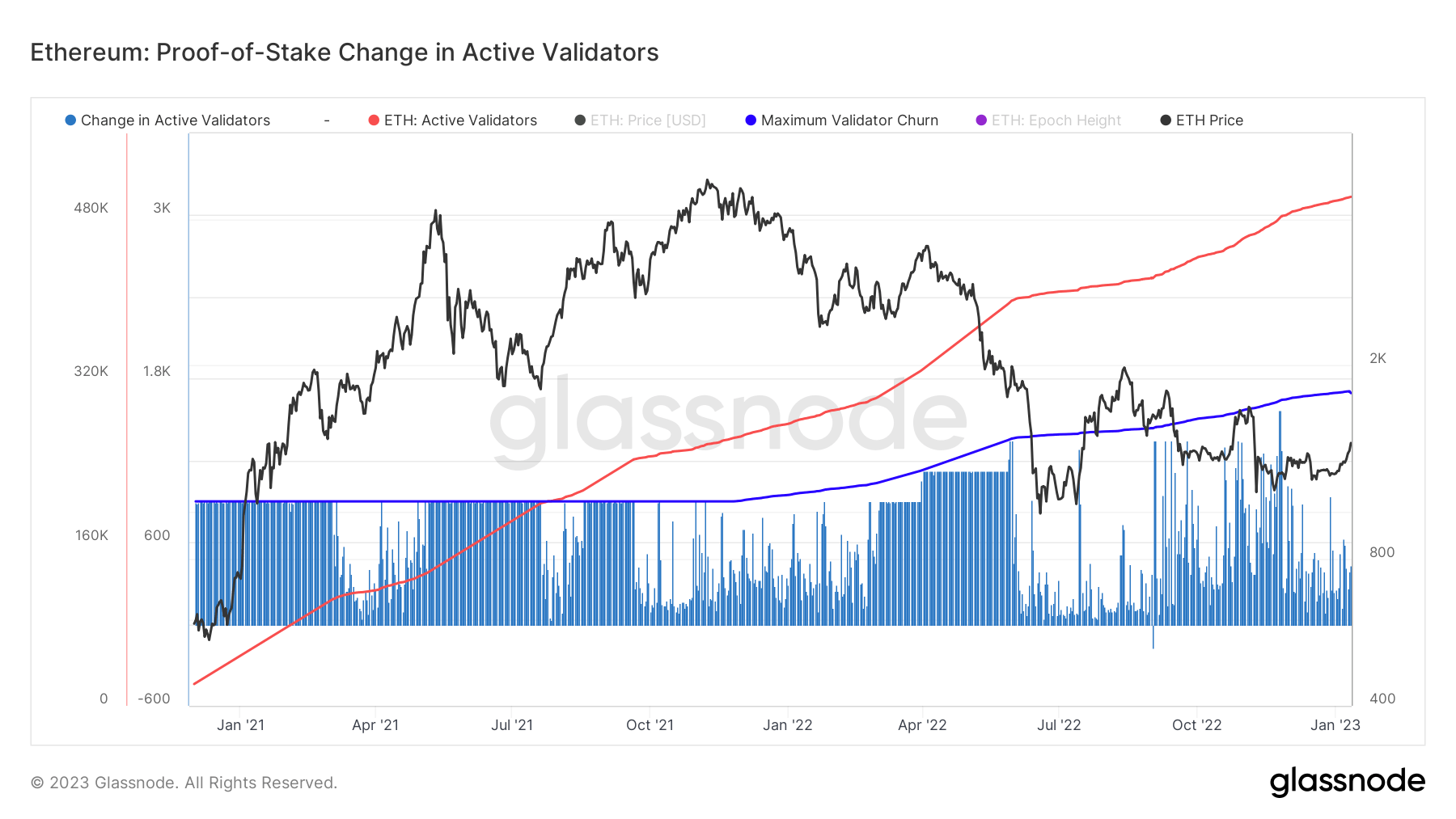

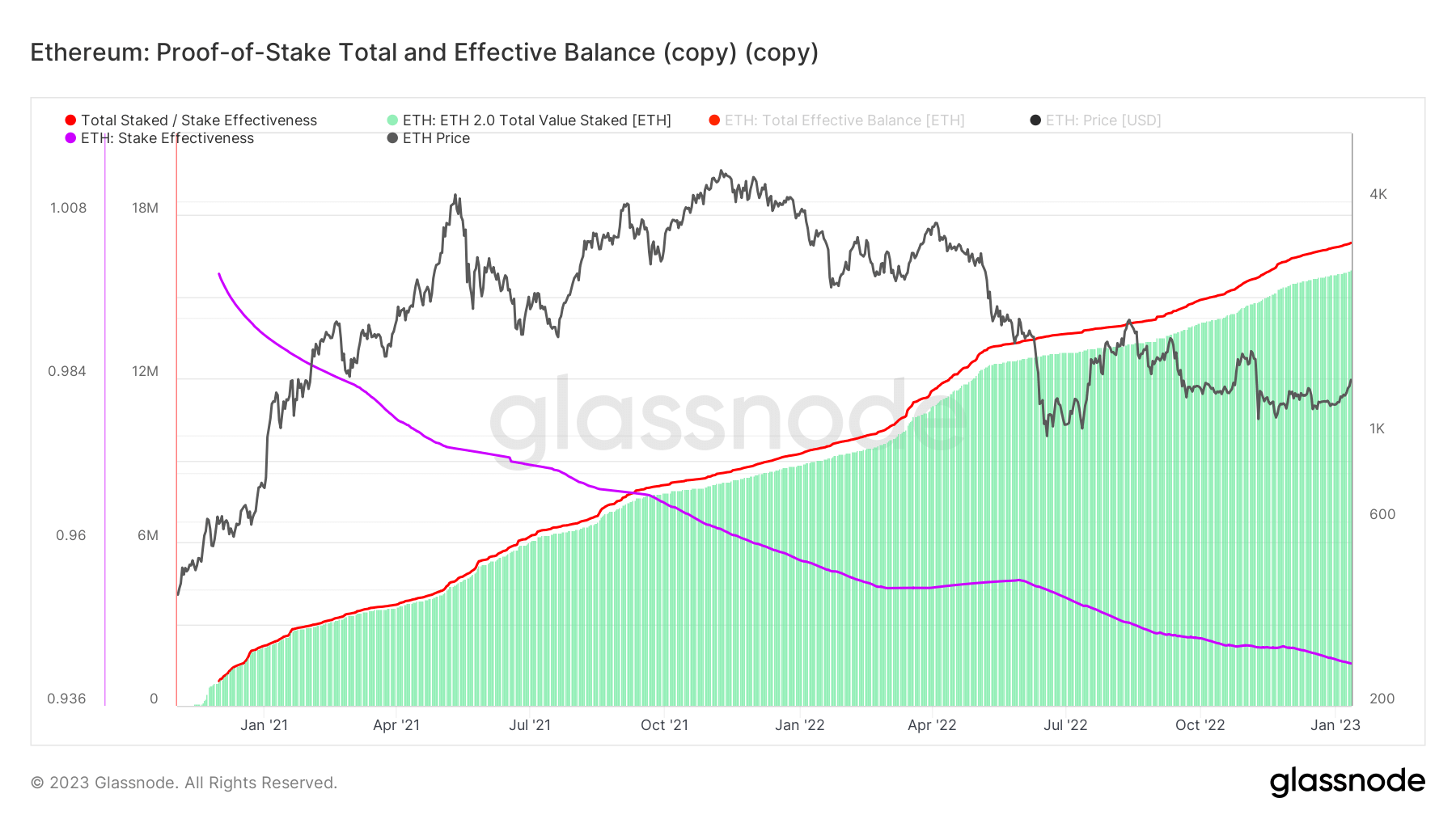

The beacon chain is organized by validators who have deposited 32 ETH before being able to begin operations. Currently, the number of beacon chain validators has reached 500,000 — with a recent burst in new active validators — with a total of over 16 million ETH staked in the ETH 2.0 deposit contract.

New ETH credentials format

Validators who wish to withdraw their staking rewards must ensure their withdrawal credentials are updated to the new “0x01” standardized format. The same prerequisite exists for validators who wish to stop validating or exit their full balance.

Currently, roughly 300,000 validators have yet to update their credentials from “0x00” while roughly 200,000 validators have already updated on the beacon chain.

Of the 500,000 total validators, the over 16 million ETH they have staked represents roughly 13% of the total ETH supply — which will change as time goes on as the result of:

- Slashing — in the event of malicious behavior.

- Revenue earned from issuance and fees.

- Inactivity leak — if validators will block or attestations.

- New deposits and, eventually, withdrawals.

Liquid Staking Derivatives

Due to the nature of staked ETH, it is an untradeable asset once staked. As such, numerous providers emerged that allowed ETH to be staked in return for a tradeable asset representing a share of the staked ETH — known as Liquid Staking Derivatives (LSD).

To date, Lido is by far the largest LSD provider, with a market holdings amount of around 5 million ETH. However, currently staking providers such as Lido, Coinbase and Binance control large segments of the ETH market — revealing issues with centralization.

![Ethereum: ETH 2.0 Total Value Staked by Provider [ETH] - Source: CryptoSlate](https://cryptoslate.com/wp-content/uploads/2023/01/eth-2-staked.jpg)

As an asset geared towards decentralization, ETH holdings amassed by the aforementioned ETH staking providers lend to the narrative that ETH is becoming too centralized — and ultimately controlled by companies with the largest holdings.

With the integration of the upcoming Shanghai upgrade, ETH investors and validators alike will be gearing up to withdraw staked ETH in favor of positions that allow the share and value of their staked ETH to be returned in the form of LSDs.

Read More: cryptoslate.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Bittensor

Bittensor  Aave

Aave  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Cronos

Cronos  OKB

OKB  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Internet Computer

Internet Computer  Ondo

Ondo