Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- STEPN rallied hard in the past few days after finding a local bottom around $0.22.

- Bitcoin’s next move could heavily influence the direction of GMT in the coming days.

Bitcoin [BTC] saw a lower timeframe rejection just above the $17.3k mark. Yet it was likely that BTC would make another push higher toward the $17.6k resistance mark. The slow gains of the king coin encouraged many altcoins on a near-term bullish trajectory.

Are your holdings in profit? Check the STEPN Profit Calculator

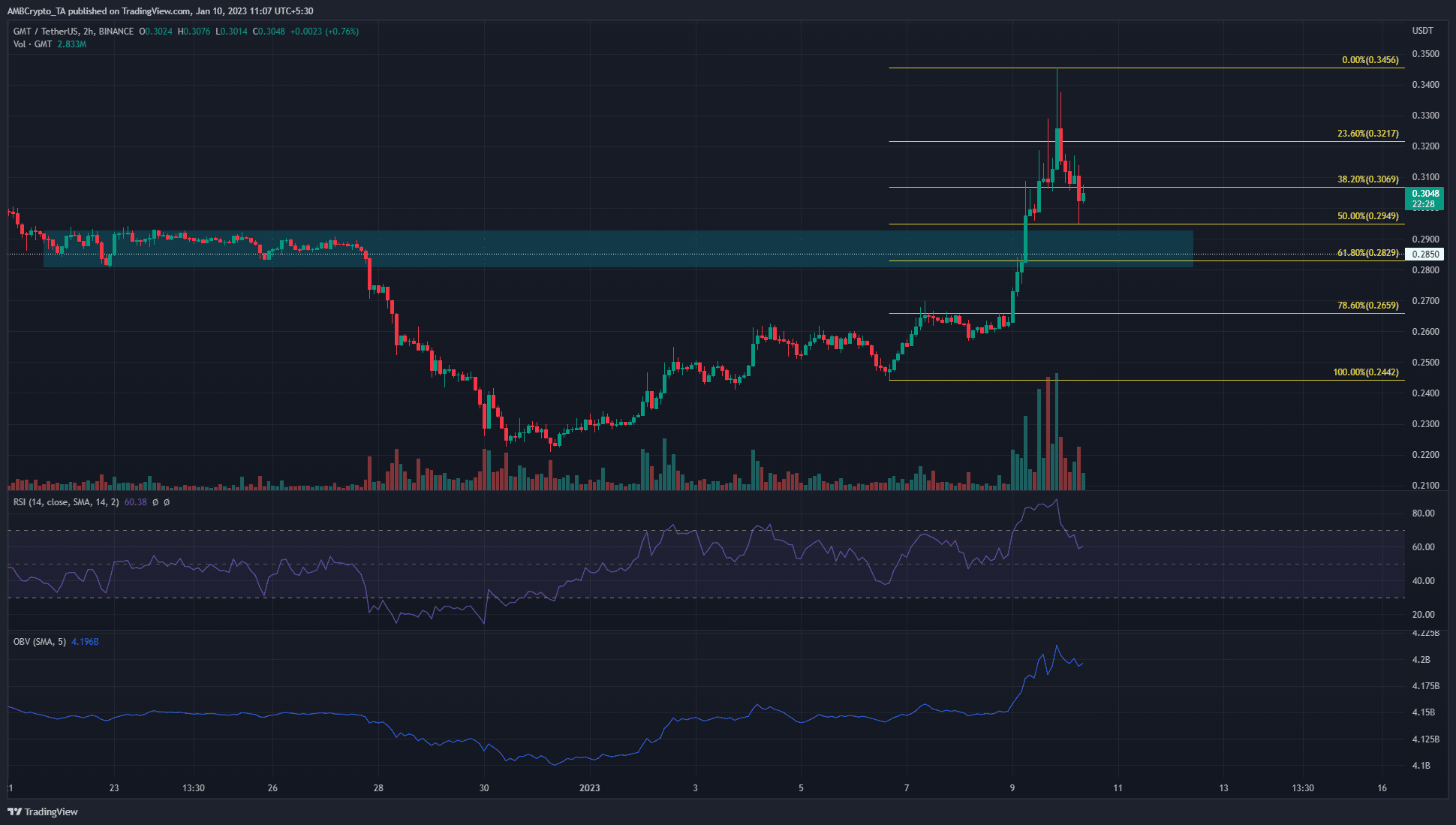

STEPN noted gains of 50% from the lows at $0.228 to the swing high at $0.325 within nine days. In the past few hours, GMT saw a sizeable pullback and was likely to drop to the region of support near $0.29.

A pullback to the 61.8% retracement level could offer a buying opportunity

Based on the move up from $0.24 to $0.345, a set of Fibonacci retracement levels was drawn. It showed the 61.8% retracement level to lie at $0.283, which was close to the $0.285 support level.

Moreover, this area was where GMT consolidated for close to a week in late December. Hence, it was likely that buyers will have some strength upon a retest of this belt.

How many GMTs can you get for $1?

On the rally upward, trading volume was also significant. The RSI and OBV showed strong bullishness in the near-term. The RSI was above neutral 50 and despite the pullback, the reading of 60 showed upward momentum. Additionally, OBV had not fallen significantly despite the sharp pullback.

Combined with the bullish lower timeframe market structure, buyers can look to enter a good risk-to-reward trade near the $0.285 level. A drop beneath the 61.8% retracement level can invalidate this idea.

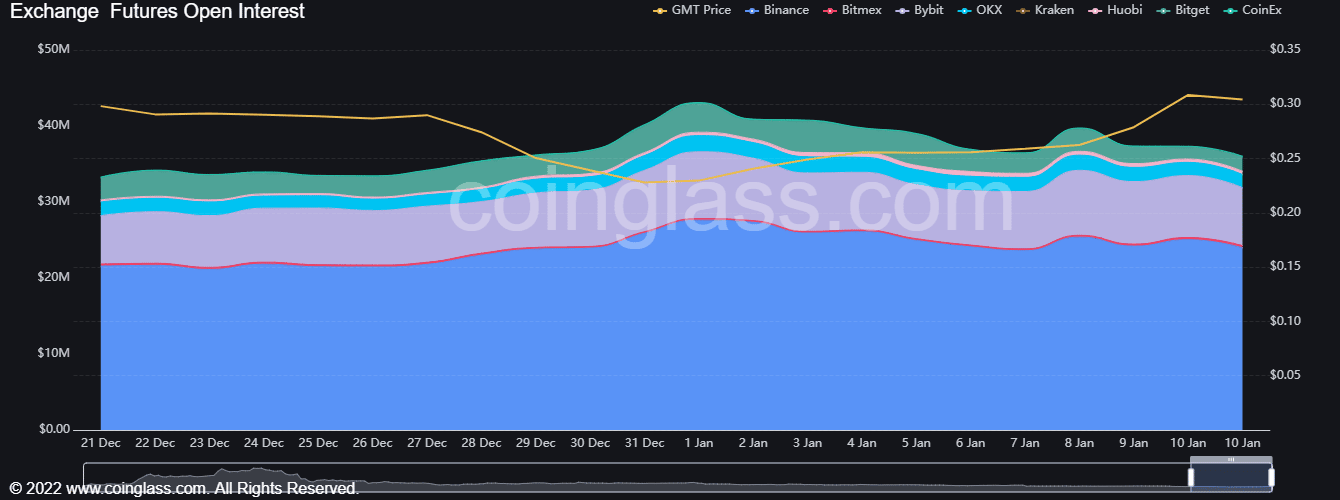

Open Interest has been falling despite the swift rally to $0.34

Source: Coinglass

The lack of a positive reaction on the Open Interest chart suggested that STEPN could be close to finding its local top. Therefore, buyers will have to be cautious. While the OBV showed strong buying volume, futures market participants did not have much bullish sentiment.

The funding rate remained positive after the rally, and this has been the case since 7 January. A drop into negative territory can further signal bearish intent.

As things stand, bulls can look to bid at the $0.285 area due to the confluence of support in that zone. However, the falling Open Interest was a sign of caution. A drop below the $0.28 mark will likely signal further losses to follow.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Stellar

Stellar  Shiba Inu

Shiba Inu  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Toncoin

Toncoin  Monero

Monero  Litecoin

Litecoin  Polkadot

Polkadot  WETH

WETH  USDS

USDS  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pi Network

Pi Network  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Aave

Aave  Uniswap

Uniswap  Dai

Dai  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  OKB

OKB  Ondo

Ondo  Official Trump

Official Trump  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer