[ad_1]

Glassnode data analyzed by CryptoSlate showed significantly greater open interest calls for Bitcoin and Ethereum.

Calls and puts refer to the buying and selling, respectively, of options. These derivative products give holders the right, but not the obligation, to buy or sell the underlying asset at some future point for a predetermined price.

This predetermined price is also called the strike price; in conjunction with the spot price, it determines the option’s “moneyness.”

Calls, where the strike price is lower than the spot price, are “in the money,” as traders can buy the option for less than the market price and sell immediately. Similarly, puts where the strike price is higher than the spot price are “in the money,” as traders can sell the option above the market price.

Being “out of the money” occurs when calls have a strike price above the market price or puts have a strike price lower than the market price.

The spread of calls and puts across different strike prices gives a general gauge of market sentiment while also giving information on traders’ expectations for future prices.

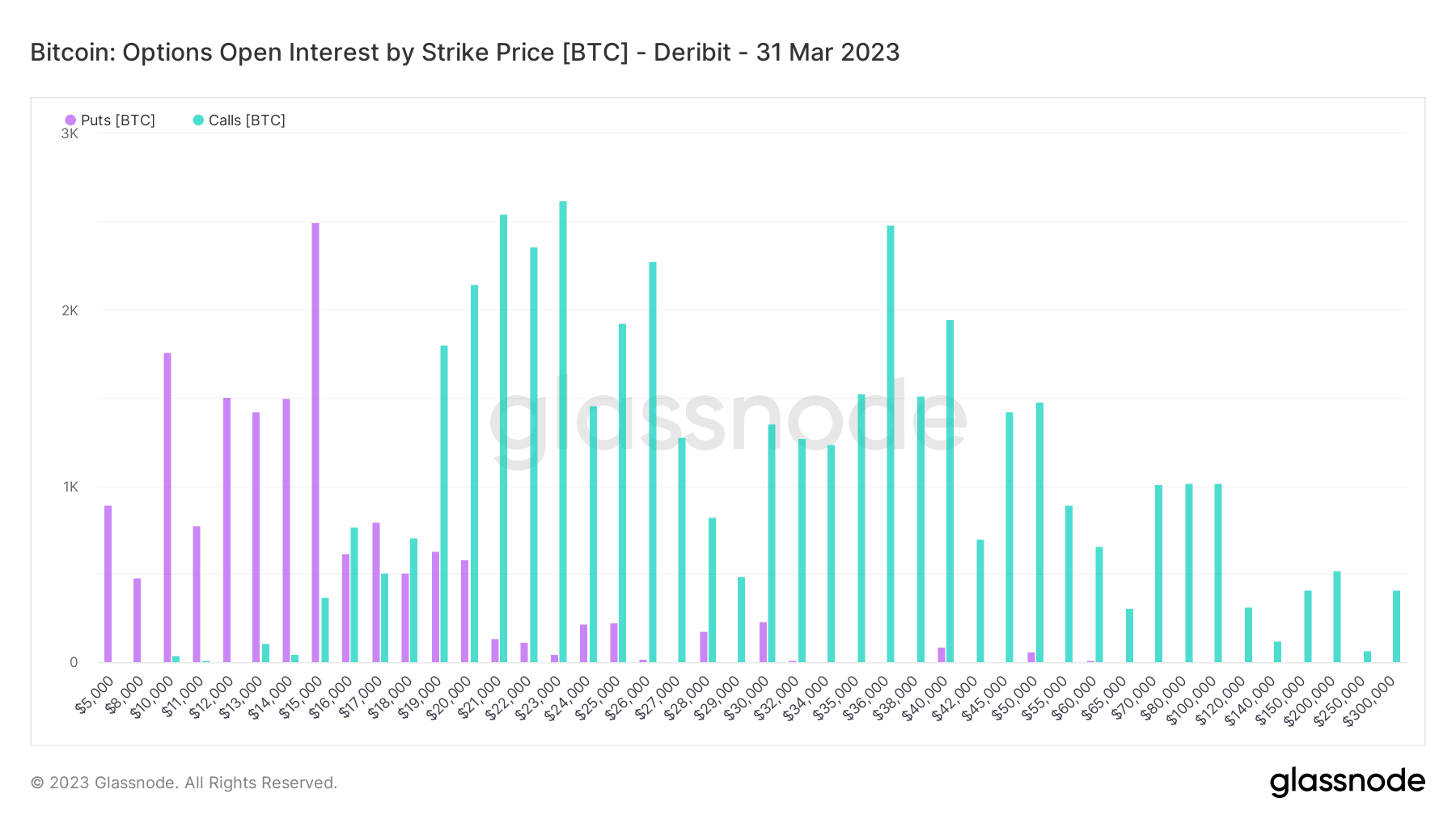

Bitcoin Open Interest

Q1 2023 Bitcoin Open Interest by Strike Price showed significantly more calls than puts, suggesting rising bullish sentiment among options traders.

Bitcoin is favored in the $15,000 – $20,000 range, where the calls and puts are approximately even. This is expected given that, since the FTX collapse, BTC has traded within this general price band.

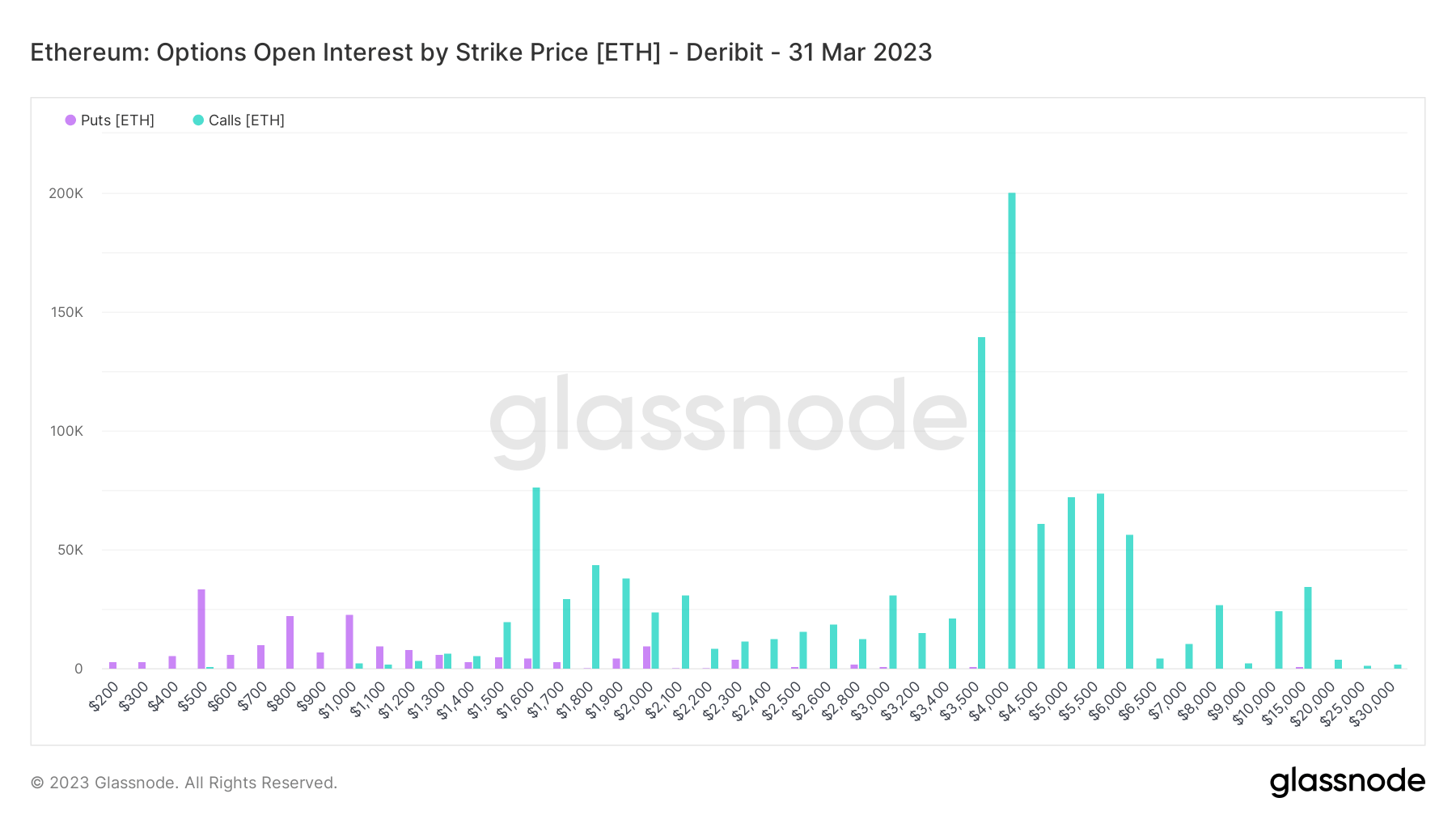

Ethereum Open Interest

Q1 2023 Ethereum Open Interest by Strike Price showed the distinct dominance of calls, adding to the bullish sentiment narrative.

Ethereum is generally considered to have a higher beta than Bitcoin. However, in a risk-off environment, this may not be the case.

It was noted that the most critical calls were for $3,500 and $4,000, at 150,000 and 200,000, respectively.

As the first week of 2023 draws to a close, uncertainty remains the overriding theme. Further macro headwinds could add to crypto stagnation, thwarting options traders’ expectations.

[ad_2]

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  USDS

USDS  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Wrapped eETH

Wrapped eETH  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Uniswap

Uniswap  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  sUSDS

sUSDS  NEAR Protocol

NEAR Protocol  Cronos

Cronos  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic