- ETC’s price has grown by 28% in the last week.

- Price chart readings, however, revealed that the alt is overbought.

Ethereum Classic [ETC] had a strong week, with its price increasing by 28.60%, according to data from CoinMarketCap. This made it one of the top-performing cryptocurrencies, along with Lido [LDO], which saw a price increase of 55%, and Solana [SOL], which had a rally of 35% within the same period.

Read Ethereum Classic’s [ETC] Price Prediction 2023-2024

A retracement in sight for Ethereum Classic?

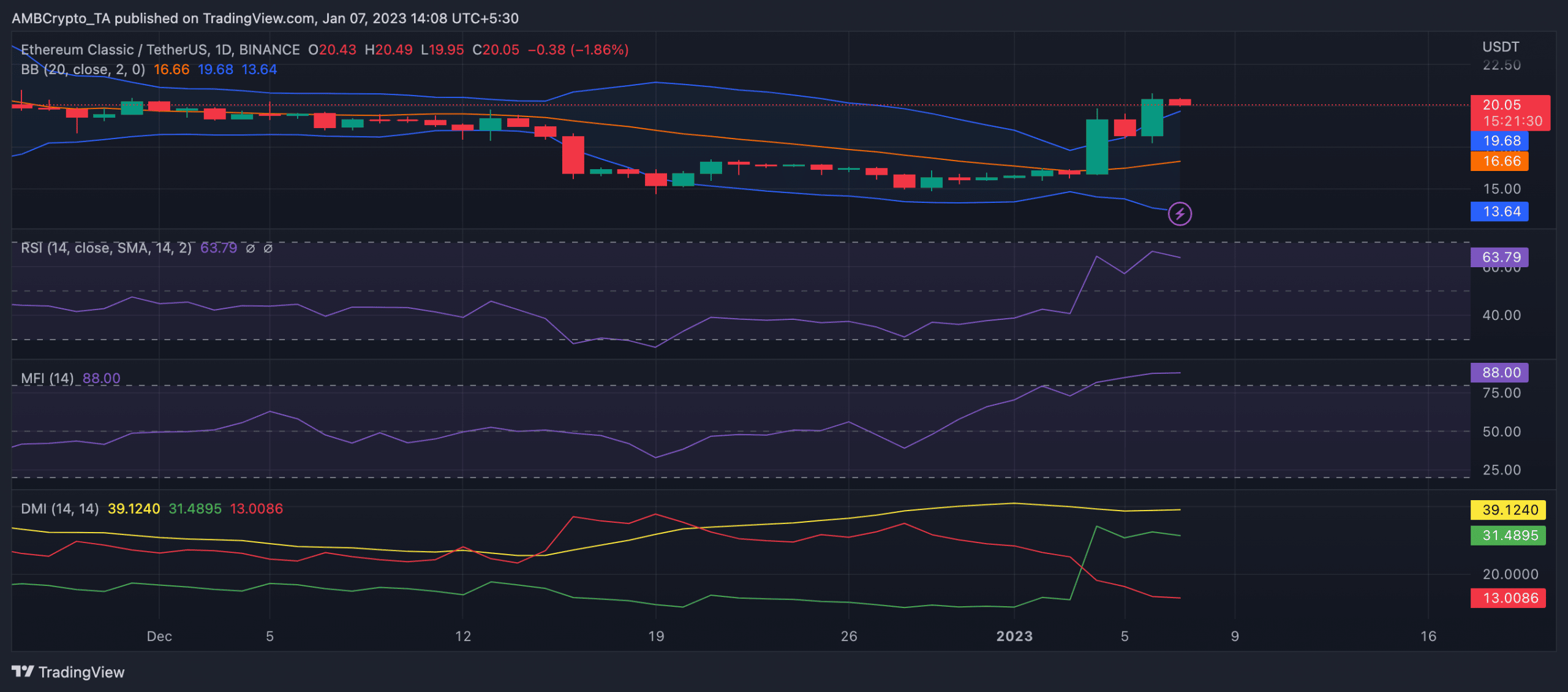

An assessment of ETC’s performance on a daily chart revealed that a price imminent might be in view, as the asset traded at overbought highs at press time.

First, its Money Flow Index (MFI) was spotted at 88 as of this writing. Toeing the same path, ETC’s Relative Strength Index (RSI) was pegged at 63.79 in an uptrend. These positions indicated that ETC was overbought.

At this point, buyers’ exhaustion is common as new demand for the asset drops, leaving the buyers in the market unable to sustain a further rally. This often results in bears regaining control and initiating a price drawback.

Further, an assessment of ETC’s Bollinger Bands (BB) showed that the altcoin was severely volatile at press time. Although ETC’s price broke above the upper band of the indicator, which indicated a continuation of the bullish trend, the width between the upper and lower bands widened. This suggested high volatility.

When a crypto asset’s price is highly volatile, it is prone to significant price swings over a short period. This can make it riskier to hold or trade the asset.

Interestingly, a look at ETC’s Average Directional Index (ADX) (yellow) showed that the buyers’ strength was a rock-hard one that sellers might find impossible to revoke in the short term.

This is because it was positioned above the Plus Directional Indicator (+DI) (green) and the Minus Directional Indicator (-DI) (red), which make up the Directional Movement Index (DMI).

How many ETCs can you get for $1?

At press time, the buyers’ strength at 31.48 was positioned solidly above the sellers at 13.00.

Caution is advised

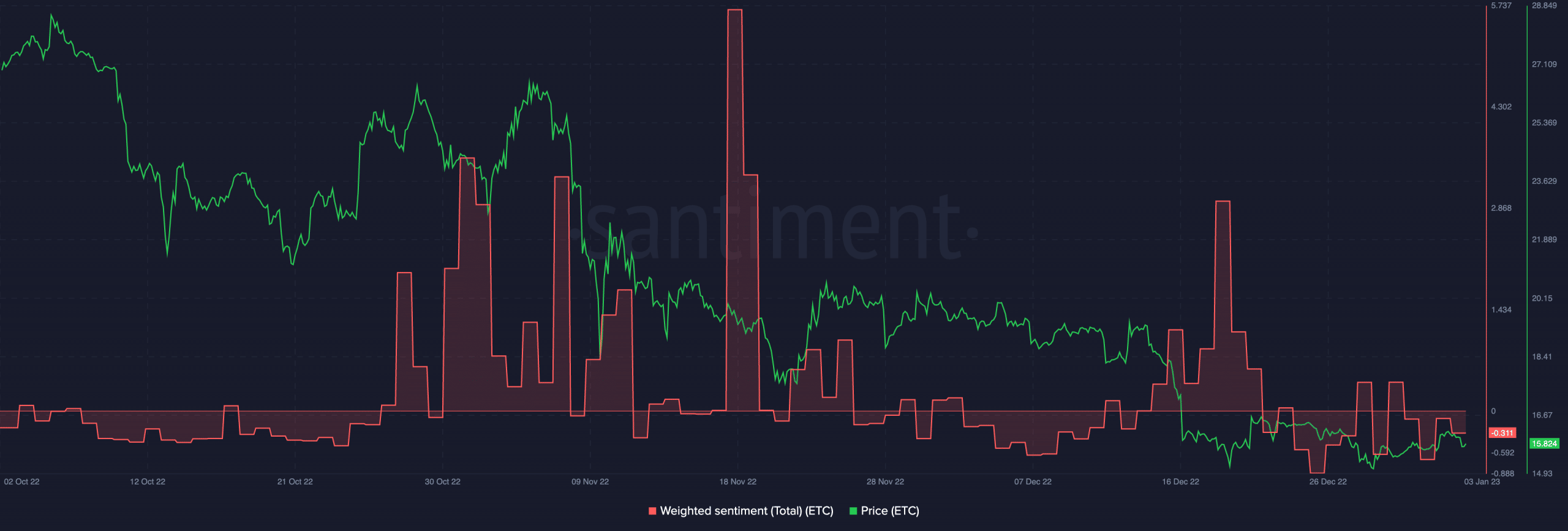

Despite ETC’s price rally in the last week, since the beginning of the year, weighted sentiment has been negative. This meant that despite the consistent growth in ETC’s value since the year started, investors still harbored negative convictions. A negative weighted sentiment often precedes a price drawback.

Read More: news.google.com

![Ethereum Classic [ETC] sends cautionary signals as price grows by over 25%](https://ambcrypto.com/wp-content/uploads/2023/01/markus-spiske-VO5w2Ida70s-unsplash-1-1000x600.jpg)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Sui

Sui  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Pi Network

Pi Network  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Shiba Inu

Shiba Inu  Stellar

Stellar  Hedera

Hedera  Toncoin

Toncoin  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Litecoin

Litecoin  LEO Token

LEO Token  USDS

USDS  WETH

WETH  Monero

Monero  Pepe

Pepe  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Dai

Dai  Ondo

Ondo  Aave

Aave  OKB

OKB  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  VeChain

VeChain