[ad_1]

In case you haven’t heard, for the next week we’re hooking you up with 10% off Bankless Premium for all of 2023. Don’t miss out on:

-

Tons of extra alpha (our monthly Token Ratings, Monday Market Reports, etc.)

-

Huge discounts on our IRL events

-

Access to The Inner Circle – our private Discord for Premium members

Upgrade to Bankless Premium, and get the best coverage in crypto all year long.

Dear Bankless Nation,

Fresh contagion fears stoked the crypto space this week as DCG’s situation grew murkier and drama at Huobi raised new alarms.

Blood is in the water.

For our weekly recap this week, we dig into:

-

Another Big Week for Barry

-

SBF, not guilty?

-

Trouble at Huobi?

-

More CeFi Drama

-

Bear Market Blues

– Bankless Team

Weekly Recap

Weekly Recap

Here’s a recap of the biggest crypto news from the first week of January.

1. Another Big Week for Barry

Let’s take stock on where Gemini is.

Gemini, the crypto exchange, has an Earn program which lets customers deposit money in exchange for a ~7% yield. That sweet yield comes from the prime brokerage firm Genesis Trading (owned by Digital Currency Group) which was managing those funds on behalf of Gemini customers, but also lending those funds to FTX.

When FTX collapsed, Genesis was exposed to a liquidity crunch. “Is Genesis bankrupt?” was the question on everyone’s minds. This leaves Gemini Earn retail customers holding the bag. Earn was halted on November 16.

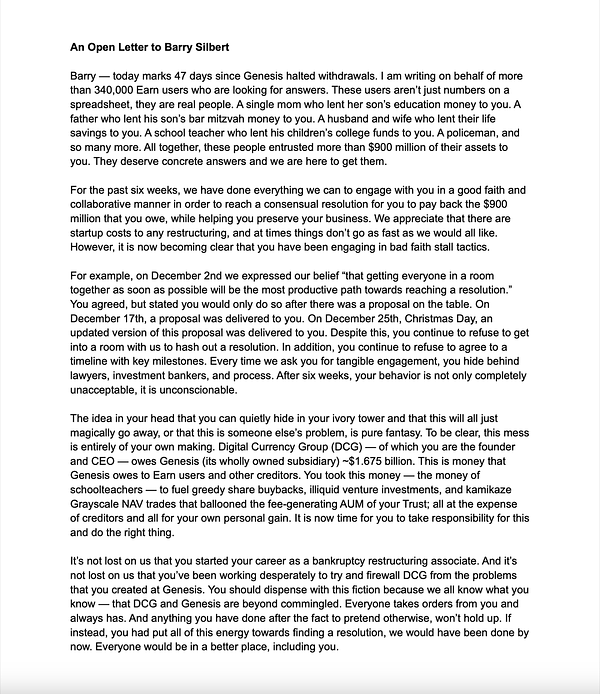

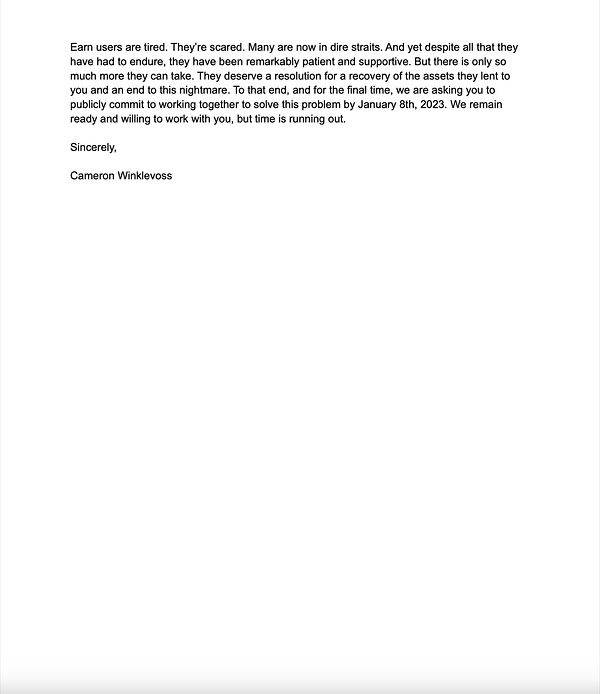

This week sees Gemini CEO Cameron Winklevoss penning a particularly provocative open letter to DCG’s CEO Barry Silbert. Winklevoss alleges that they “have done everything we can to engage with you in good faith” but “it is now becoming clear that you have been engaging in bad faith stall tactics”.

DCG owes Genesis ~$1.675 billion. This is money that Genesis owes to Earn users and other creditors. You took this money – the money of schoolteachers – to fuel greedy share buybacks, illiquid venture investments, and kamikaze Grayscale NAV trades that ballooned the fee-generating AUM of your Trust; all at the expense of creditors and all for your own personal gain. It is now time for you to take responsibility for this and do the right thing.

<div class="tweet" data-attrs="{"url":"https://twitter.com/cameron/status/1609913051427524608?s=20&t=x6cLHdfx34qV7qBNSJtzIg","full_text":"Earn Update: An Open Letter to @BarrySilbert ","username":"cameron","name":"Cameron Winklevoss","date":"Mon Jan 02 14:02:36 +0000 2023","photos":[{"img_url":"https://pbs.substack.com/media/FlePP-1akAAknU5.png","link_url":"https://t.co/kouAviTho4","alt_text":null},{"img_url":"https://pbs.substack.com/media/FlePQfUaYAEWPYl.png","link_url":"https://t.co/kouAviTho4","alt_text":null}],"quoted_tweet":{},"retweet_count":2178,"like_count":9968,"expanded_url":{},"video_url":null,"belowTheFold":true}”>

DCG reportedly shut down its wealth management division this week.

Meanwhile, Genesis has announced a cut of 30% of its staff, down to 145 employees. DCG/Genesis is also allegedly under investigation by the SEC.

**sources confirmed that there are multiple whistleblowers that have come forward.

Gemini COO Noah Perlman is also calling it quits.

2. SBF, not guilty?

In what seems to be gearing up to be the court case of the decade, Sam has plead “not guilty” in a New York federal court Tuesday to the bouquet of wire fraud charges he faces. This, despite his comrades Alameda CEO Caroline Ellison and FTX co-founder Gary Wang pleading guilty.

Why is Sam rolling the dice? It’s possible Sam was offered a terrible plea deal, and is holding out for a better offer. Perhaps he has friends in high places that would get him out of this pickle. David Morris of CoinDesk has a comprehensive write-up.

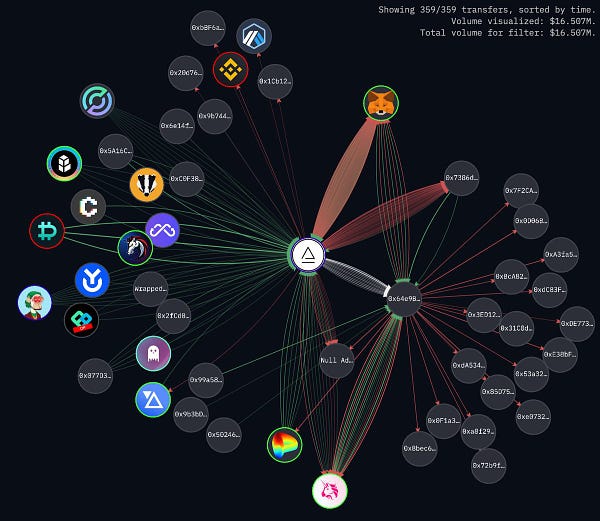

A bunch of Alameda wallets were seen transferring funds totaling ~$1.7M of crypto into crypto mixers last week on December 28, days after Sam was released on bail.

These wallets had been inactive for multiple weeks before they ‘woke up’ last night.

Over $1M has been sent through crypto-mixers by Alameda wallets.

What gives?

Sam denies being the one behind these activities.

Lewis Kaplan, the U.S. district judge overseeing Sam’s case, isn’t taking any chances and is formally blocking Sam from accessing FTX assets.

Finally, Sam’s trial date is set for October 2, which makes for another nine glorious months of the Sam Bankman-Fried saga. All praise the efficiency of the U.S. justice system.

3. Troubles at Huobi?

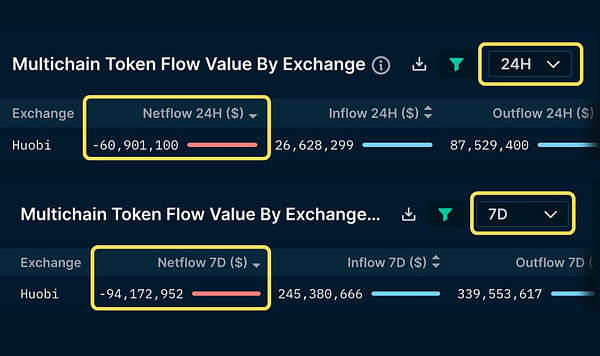

The Seychelles-based crypto exchange Huobi is having some troubles of its own. Nansen data is showing record high net outflows of $~94M of USDC, USDT and ETH in the last week.

$60.9M* of the $94.2M* net outflow in the past week occurred in the past day alone

*Contains Ethereum, Avalanche, BNB Chain, Fantom, & Polygon flows

Coupled with Huobi announcing layoffs of about ~20% of its staff, rumors of insolvency are kicking off.

The exchange is apparently making it mandatory for employees to take salaries in stablecoins, and also shut down its internal employee communication channels to “quell a rebellion [which has] taken a toll on its exchange token and trading volume”.

Huobi’s exchange token HT is down 9.3% to $4.66 in the last seven days. This is particularly distressing. According to CryptoQuant’s “clean reserve” metric which looks at how much an exchange’s assets is represented by its own token, Huobi currently has 59.64%.

Justin Sun, the face behind Huobi, has cashed out ~1.5B in fiat stablecoins since October.

Meanwhile, Justin Sun (an “advisor” to the exchange, seen by many as the man in charge) has cashed out $1.5B+ in fiat since October, according to his tagged wallets

But hey, here’s Justin Sun with some words of encouragement that will assuage the fears of absolutely nobody.

<div class="tweet" data-attrs="{"url":"https://twitter.com/justinsuntron/status/1611297498588663810","full_text":"At @HuobiGlobal, we believe that the key to success in the world of cryptocurrency is to \"Ignore FUD and Keep Building.\"","username":"justinsuntron","name":"H.E. Justin Sun

Thanks to our sponsor

Thanks to our sponsor  Across.to is the bridge you deserve!

Across.to is the bridge you deserve!

See all listings on the

See all listings on the

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  USDS

USDS  Toncoin

Toncoin  Shiba Inu

Shiba Inu  WhiteBIT Coin

WhiteBIT Coin  Hedera

Hedera  Litecoin

Litecoin  WETH

WETH  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Uniswap

Uniswap  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Bittensor

Bittensor  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Cronos

Cronos  Internet Computer

Internet Computer  sUSDS

sUSDS  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic