- Grayscale Ethereum Trust premium noted a sharp decline of almost 30% in just two months.

- Back in December 2022, Grayscale Bitcoin Trust also registered the highest discount of 48.89%.

- Ethereum price, despite noting minimal recovery, is still in a macro uptrend, trading around $1,200.

Grayscale has been making headlines for all the wrong reasons over the last few months as the crypto winter reached its digital asset investment options. Following the Grayscale Bitcoin Trust’s (GBTC) all-time high discount, the asset management company’s Ethereum Trust premium also registered historical lows.

Grayscale takes another hit

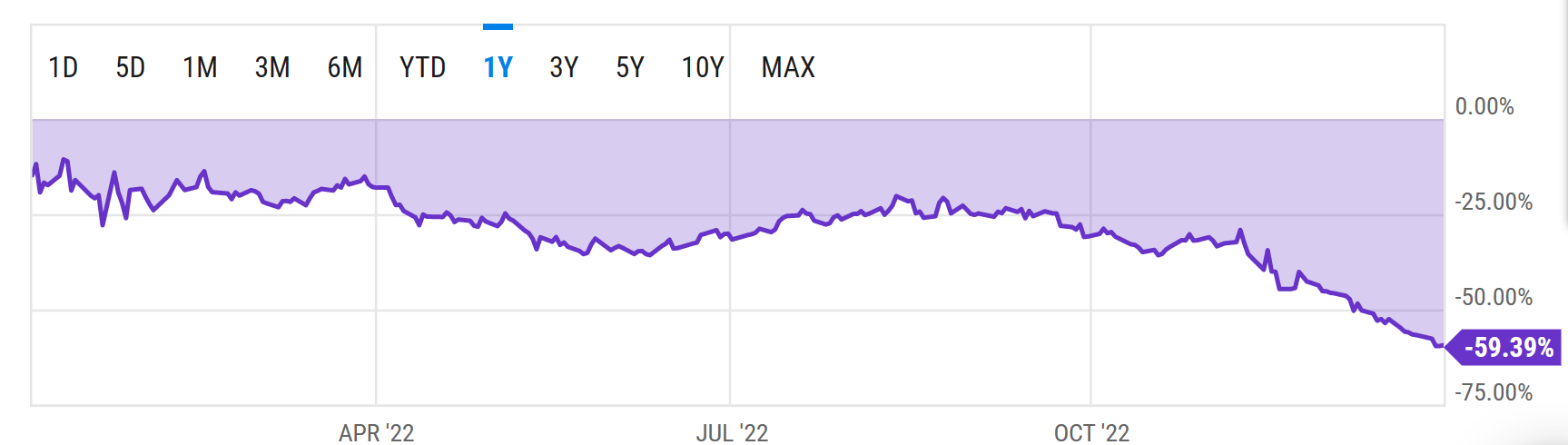

Grayscale Ethereum Trust (ETHE) fell to its lowest-ever value as the investment product registered a discount of almost 60% to its net asset value (NAV). Although the Ethereum Trust was already trading at a discount of 30%, the sudden drop came around November following the FTX collapse.

Grayscale Ethereum Trust discount to NAV

Consequently, ETHE’s premium fell by almost 30% within a month, resulting in its current value. This comes after Grayscale’s Bitcoin investment product, Grayscale Bitcoin Trust, recorded its highest-ever discount of 48.89% last month. Albeit in the case of GBTC, recovery has been relatively better as, at the time of writing, the investment vehicle was trading at a discount of 45.17%.

In addition to this, Grayscale also faced the Securities and Exchange Commission’s (SEC) scrutiny after filing a lawsuit against the regulatory authority. The SEC was noted saying that a spot ETF was susceptible to fraud and manipulation, reiterating its rejection of Grayscale’s request for a Bitcoin spot ETF.

US regulator justified this reasoning by saying the spot ETFs lacked federal oversight, unlike Bitcoin Futures which are monitored by the Chicago Mercantile Exchange (CME).

Ethereum price remains sideways bound

Ethereum price could be seen trading at $1,208 at the time of writing, rangebound between its immediate resistance and support levels at $1,240 and $1,187, respectively. While on the micro timeframe, the altcoin king is facing a struggle to recover its losses, on the macro, the cryptocurrency is doing far better. Despite dropping by almost 11.5% in December, ETH remain in a longer-term uptrend, preparing for a rise toward $1,300.

If the bullish momentum kicks in, Ethereum price could breach $1,240 and set sights at flipping $1,306 into a support floor. Such a scenario would allow the ETH price to prepare a rise toward $1,352 and initiate recovery.

ETH/USD 4-hour chart

However, if Ethereum loses the support of the uptrend line and falls below $1,187, it would need to find stability around the critical support level at $1,148. If it fails to do so, a daily candlestick close below this level would invalidate the bullish thesis and lead ETH to tag the lows of $1,082.

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  LEO Token

LEO Token  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  Wrapped stETH

Wrapped stETH  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  WETH

WETH  Ethena USDe

Ethena USDe  Pi Network

Pi Network  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Wrapped eETH

Wrapped eETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Uniswap

Uniswap  Aptos

Aptos  Dai

Dai  Ondo

Ondo  OKB

OKB  NEAR Protocol

NEAR Protocol  Bittensor

Bittensor  Gate

Gate  Internet Computer

Internet Computer  Tokenize Xchange

Tokenize Xchange  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund