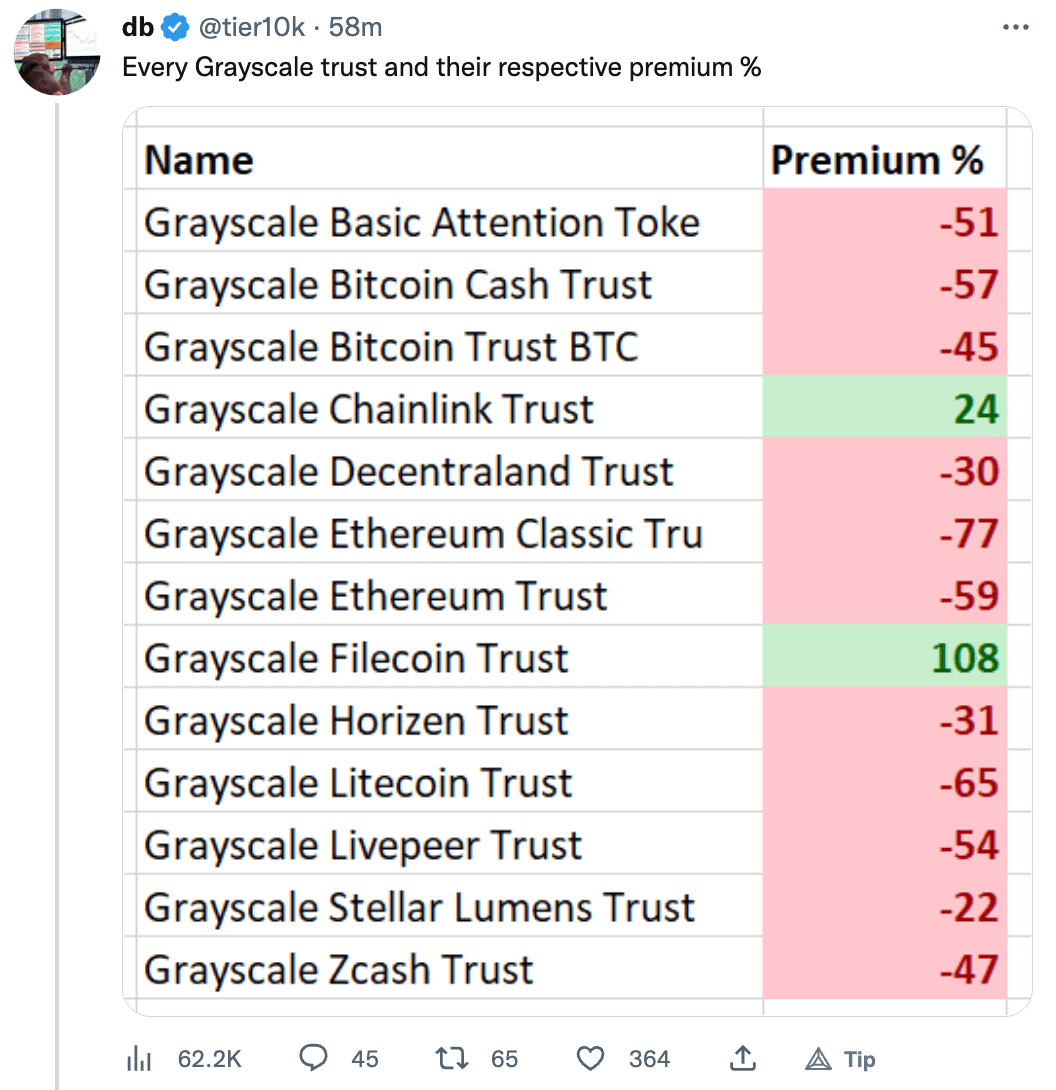

The Grayscale Ethereum Trust (ETHE) is trading at a record-low discount rate of 59%, according to the data shared by the crypto influencer DB.

The Grayscale trust gathers money from institutions that wish to invest in various cryptocurrencies but want to avoid the challenges of buying, storing, or safekeeping their crypto. The funds collected under ETHE are used to purchase Ethereum (ETH) to expose institutional investors to ETH passively.

There is currently $3.6 billion worth of assets under the ETHE pool collected from 31 million shares. The ETH per share is around 0.0097 ETH, and the market price per share is $4.77.

Community concerns about Grayscale

According to the data, ETHE is not the only Grayscale fund that is struggling. On Dec. 8, the Grayscale Bitcoin Trust (GBTC) reached a record-low discount of 49,20%. The GBTC has healed only slightly since then, with a discount rate of 45.

Recently, Grayscale has been facing speculations regarding its financial stability. On Nov. 16, Grayscale’s sister company Genesis halted withdrawals, raising questions regarding insolvency. Soon after, reports revealed that both companies’ parent institutions had a debt of around $2 billion to Genesis.

Even though Grayscale’s partner Coinbase assured the community that Grayscale held enough Bitcoin (BTC) to remain liquid, Grayscale refused to provide proof of its BTC reserves, which didn’t help soothe the community concerns.

Read More: cryptoslate.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Stellar

Stellar  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Litecoin

Litecoin  Monero

Monero  Polkadot

Polkadot  USDS

USDS  WETH

WETH  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Pi Network

Pi Network  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pepe

Pepe  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Aave

Aave  Dai

Dai  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Official Trump

Official Trump  Tokenize Xchange

Tokenize Xchange  Cronos

Cronos