- Ethereum OFAC-compliant blocks have dropped, according to recent data.

- Ethereum validators are also planning to employ an update that would see OFAC compliance reduced by 35%.

After this year’s merge, Ethereum [ETH] changed from a Proof-of-Work (POW) to a Proof-of-Stake (POS) network. Because of the consolidation, validators are now responsible for protecting transactions and the integrity of the network.

Read Ethereum’s [ETH] Price Prediction 2023-24

However, censorship of blocks on Ethereum became a heated topic, and the success of the merge was quickly forgotten. Some analysts were also dissatisfied with the dominance of OFAC-compliant MEV-boost relays and blocks.

OFAC-compliant blocks on the rise

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) blocked the Tornado Cash mixer program in August. In response to the OFAC’s decision, Flashbots, an Ethereum research and development firm, revealed some significant updates.

The company declared that it would begin censoring transactions using a critical component of the infrastructure, relied on by validators operating Ethereum’s POS network. The resultant effect was OFAC-compliant blocks.

The current state of MEVs

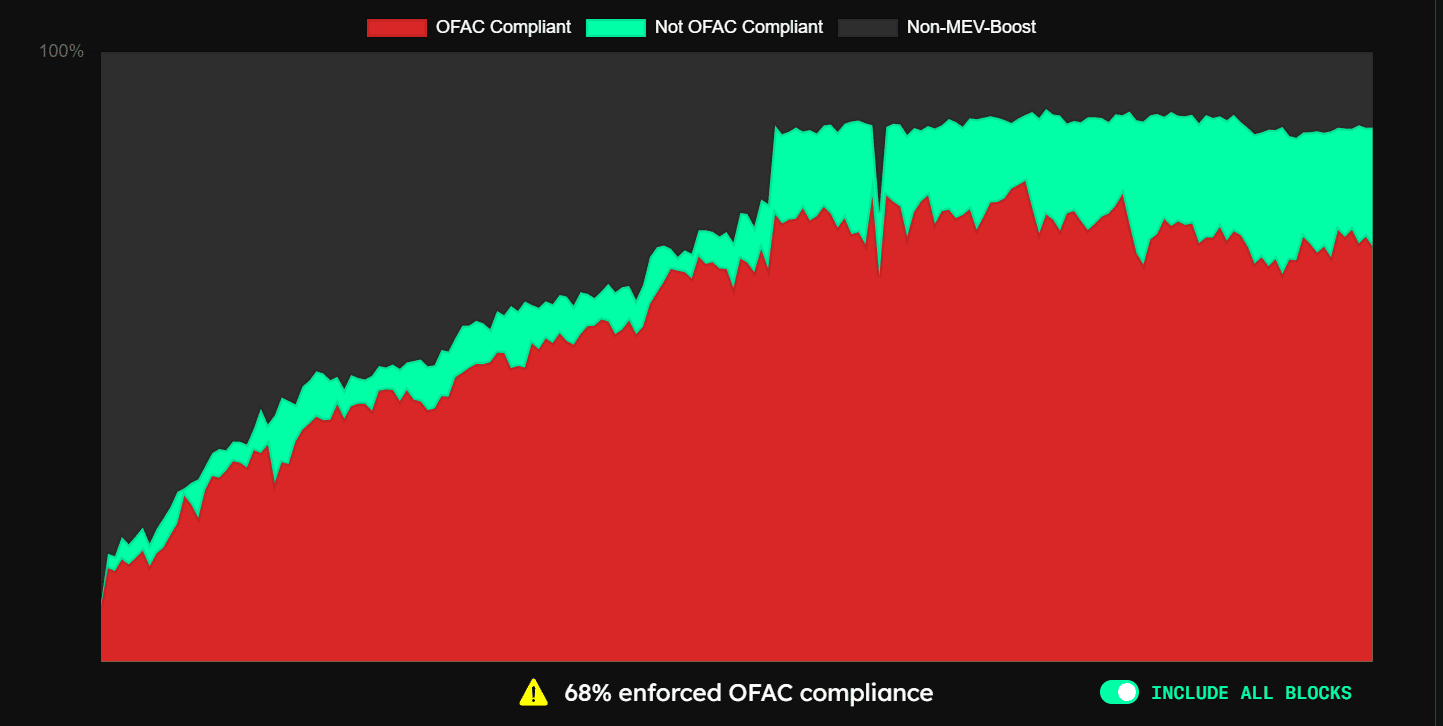

Information from mevwatch.io revealed that in September, the proportion of OFAC-compliant blocks started rising sharply, eventually becoming the most dominant MEV. During November, compliant blocks reached a high of 79%, with non-compliant blocks reaching 11% and 10%, respectively.

However, as of this writing, the percentage of followers had declined to 68%, with 57% compliant blocks overall. This progress was made thanks to the consistent efforts of all players, especially Flashbots.

By refusing Maximal Extractable Value (MEV) payments below 0.05 ETH, validators might reduce OFAC compliance by 35%, according to research released by Flashbots in November and cited by Messari. This decision would have a minor impact on their earnings.

Stakers rise either way

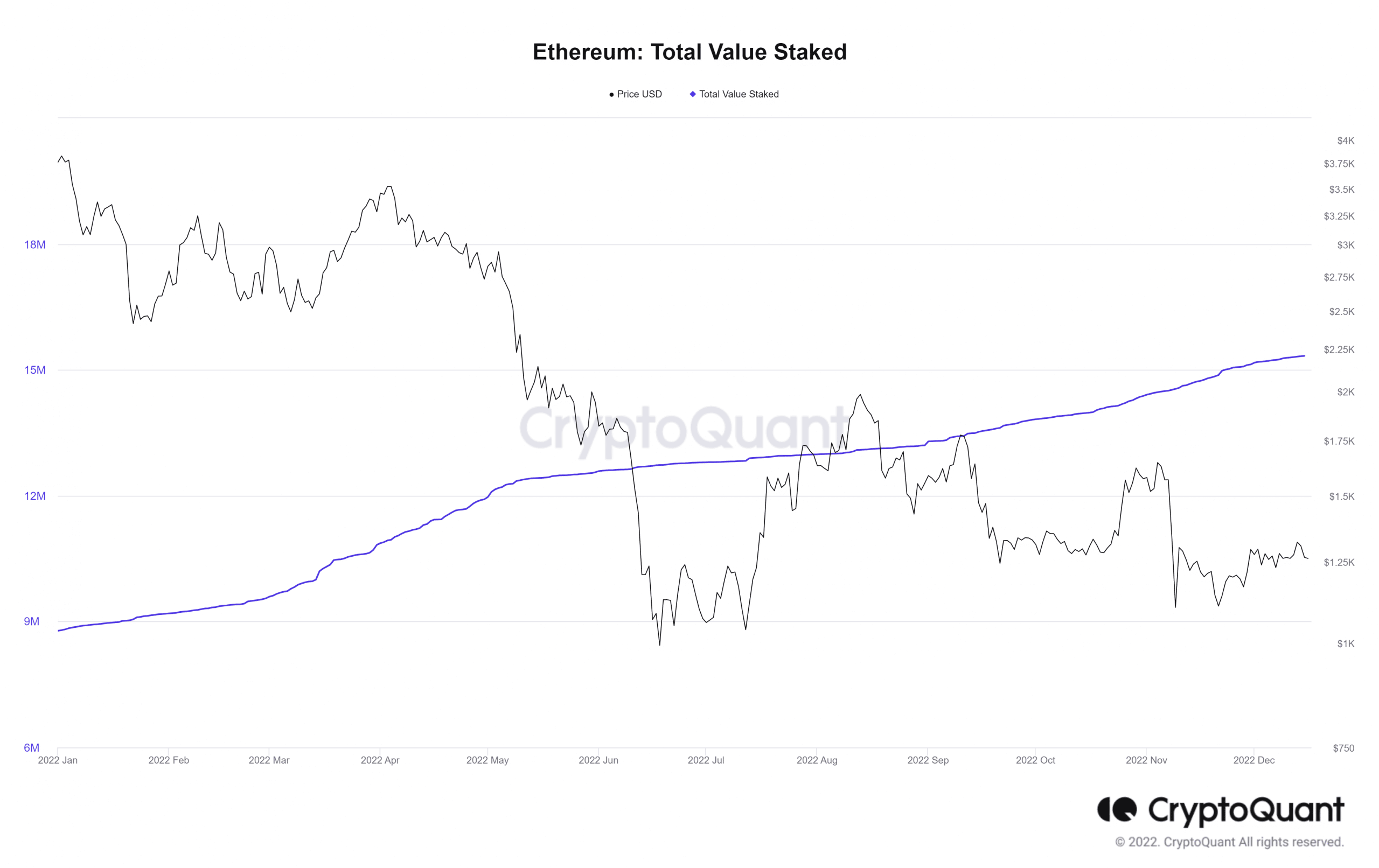

ETH stakers continued to be active in their operations despite the concerns regarding the compliance blocks. The value had been increasing, as evidenced by the Total Value Staked metrics from CryptoQuant.

According to the data, as of 15 December, there had been more than $15 million in stake. This meant that despite the concerns regarding compliance and the centralization of ETH validators, more ETH was being staked.

ETH faces decline

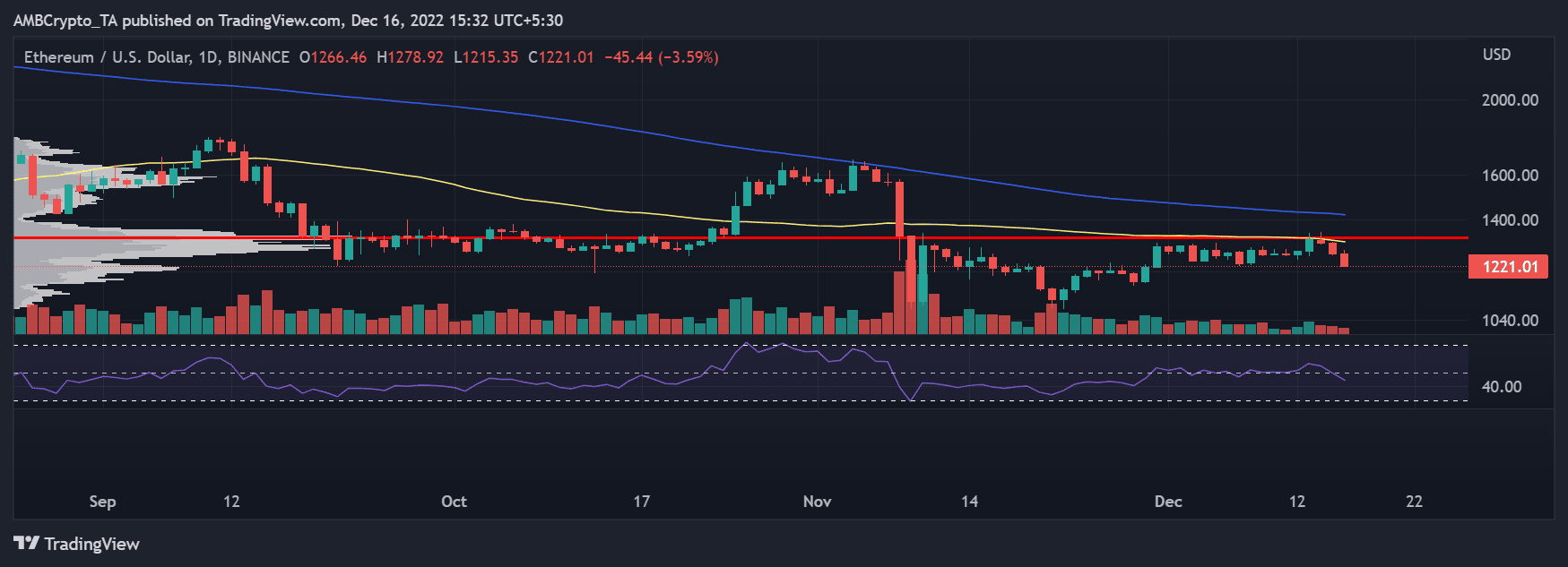

A daily period chart of Ethereum (ETH) revealed that it had lost about 7% of its value over the previous 48 hours. The FOMC report that was made public on 14 December may also have contributed to the price decline.

The short and long Moving Averages (the yellow and blue lines) were found to be acting as resistance. The yellow line formed the resistance level at $1,300, while the blue line did the same around $1,500.

According to the Relative Strength Index metric, which was below 50, the overall trend of ETH was bearish. Given that it had already reached the high-volume node zone, the Visible Range Volume Profile metric also suggested that there was a chance of a further drop. ETH was worth approximately $1,200 at the time of writing.

The Ethereum community’s efforts to make the platform censorship-resistant and neutral are paying off. This change may cause the number of compliant blocks to gradually diminish.

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Shiba Inu

Shiba Inu  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Hedera

Hedera  Toncoin

Toncoin  Monero

Monero  Litecoin

Litecoin  WETH

WETH  Polkadot

Polkadot  USDS

USDS  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pepe

Pepe  Pi Network

Pi Network  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Aave

Aave  Bittensor

Bittensor  Dai

Dai  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  OKB

OKB  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer