Disclaimer: The datasets shared in the following article have been compiled from a set of online resources and do not reflect AMBCrypto’s own research on the subject.

Polkadot (DOT) is trading at $4.5, down by more than 90% of its all-time high of $55 (November 2021). DOT showed a comparatively low tendency to cause price inconsistency. In fact, according to analysts, investors are advised to forgo buying DOT coins in the short-term. Its performance has remained unsatisfactory because of the ongoing bearish market.

Read Price Prediction for Polkadot [DOT] for 2023-24

Polkadot (DOT) is today the 12th largest cryptocurrency with an overall valuation of a little above $5 billion. Following FTX’s collapse, DOT’s price hovered around the $6 region. Polkadot has been consistently providing infrastructure to other chains over its multi-chain network, Kusama. This year has been no different. There were integrations with node services, NFTs, and dAPP staking mechanisms.

In a blog post published last month, the Polkadot team provided updates on their Roadmap Roundup.

The post described the Asynchronous Backing which aims to accomplish three things: reduce the duration of parachain blocks to six seconds, increase the amount of block space available to each block by a factor of 5-10, and allow parachain blocks to be reused when they don’t make it onto the relay chain on the first try.

The transactions per second (TPS) capacity of the network is also expected to increase in aggregate to 100,000-1,000,000, thanks to the update.

Prior to its launch, the Polkadot project had raised over $144.3 million through the Web3 Foundation in an ICO itself in October 2017. DOT was trading at $6.30 in August 2020 and kept oscillating between $4 and $5 throughout the rest of 2020.

The crypto bloom of 2021 proved to be wondrous for Polkadot too. Throughout the year, it remained bullish and reached its ATH of $55 in November. Similarly, the crypto crash witnessed in the second quarter of 2022 impacted its performance adversely. By mid-July, it was trading at just a little above $6.

A proof-of-stake (PoS) blockchain, Polkadot recently upgraded to the v9270 version which was reflected in some upward movement in its price. A few days back, its performance was rather resurgent. But with the Merge, Ethereum has emerged as a serious competitor of Polkadot as an alternative PoS blockchain and DOT’s price has been plunging since then.

Polkadot Co-Founder Robert Habermeier, however, claimed that he is super happy to see Ethereum transition from PoW to PoS mechanism. In fact, he views Polkadot as an “ETH collaborator.” Polkadot, at press time, was trading at $4.32.

In December 2021, the largest telecommunication company in Europe, Deutsche Telekom, bought a large amount of DOT tokens. T-Systems Multimedia Solutions, its subsidiary, has also bought a large amount of DOT tokens to help groups staking on the Polkadot network.

Working on the proof-of-stake consensus mechanism is unique in supporting multiple interconnected chains, helping it earn a large number of users.

Shawn Tabrizi, the lead developer at Polkadot network, talked about the possibility of “a cohesive, multi-blockchain future” during an interview in February 2022. He also stressed on the need for preserving the fundamentals of data privacy in the Polkadot ecosystem.

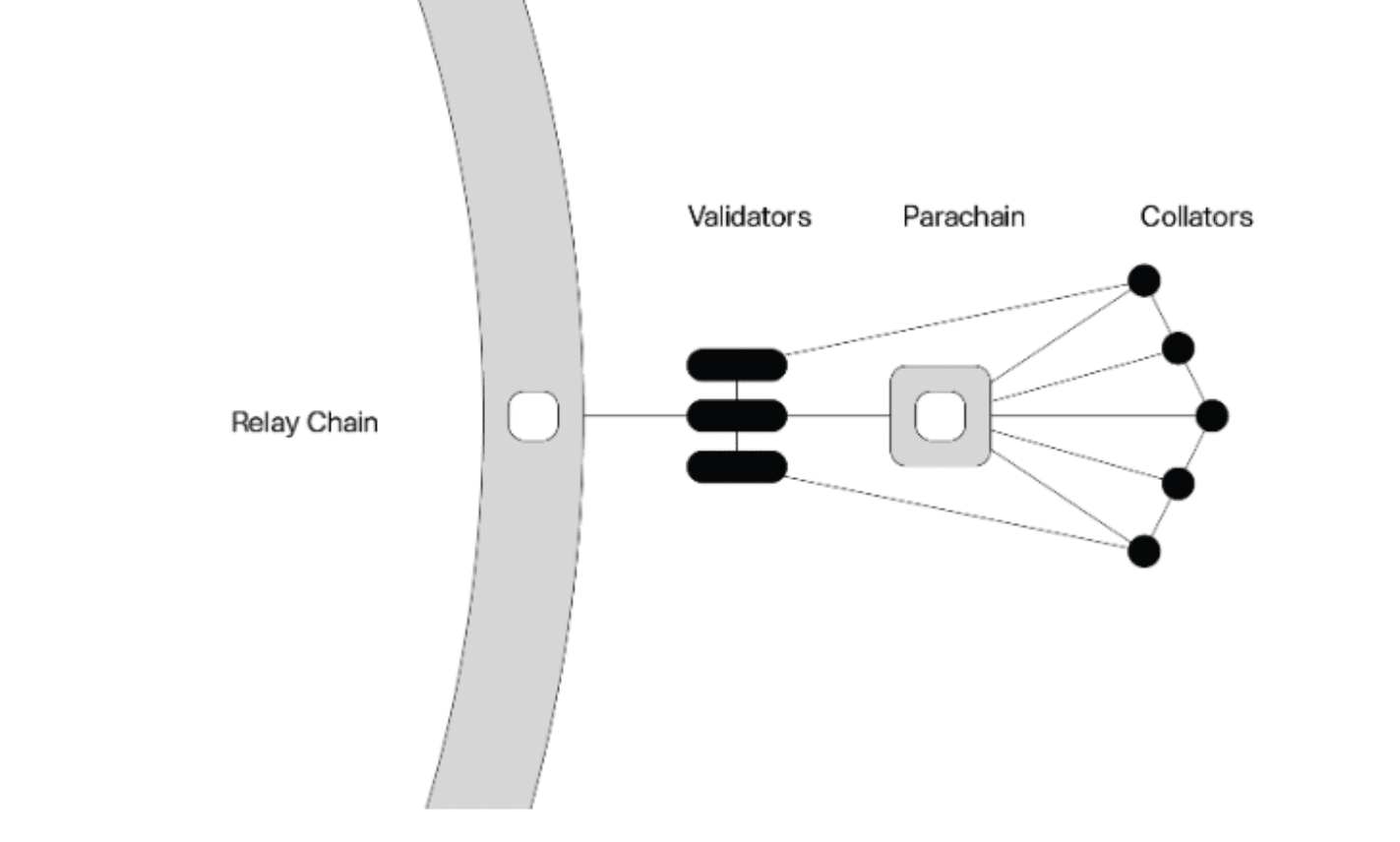

The Polkadot infrastructure supports two kinds of blockchains, relay chains, and parachains.

The central blockchain of the Polkadot infrastructure is the Relay Chain where validators provide consensus for a transaction. The Relay Chain is built in a way so as to coordinate the management and operation of the whole Polkadot infrastructure, with minimal functionality in regard to other applications.

A parachain, on the other hand, is an application-specific chain on the Polkadot infrastructure that is validated by the validators of the Relay Chain itself. Since these chains run parallel to the Relay Chain, they are called parachains. It is here that developers can develop both applications and their own blockchains. All of these parachains can communicate with each other on the network. In short, this cross-chain technology facilitates the transfer of both assets and data across blockchains. Users therefore don’t have to depend on a particular system for all of their cryptocurrency transactions.

Polkadot parachains can easily communicate with other blockchains existing on Ethereum and Bitcoin networks. The blockchain also provides better control, flexibility, and security, reducing the risk to its miners due to unauthorized validators. Acala, Moonbeam, Clover, Astar, and Parallel are some of the oldest projects running on the Polkadot network. The blockchain is growing rapidly and seems to promise a reliable future to its users.

Polkadot parachains can easily communicate with other blockchains existing on Ethereum and Bitcoin networks. The blockchain also provides better control, flexibility, and security, reducing the risk to its miners due to unauthorized validators. Acala, Moonbeam, Clover, Astar, and Parallel are some of the oldest projects running on the Polkadot network. The blockchain is growing rapidly and seems to promise a reliable future to its users.

Wood believes that from a Web 3.0 perspective, the inter-chain blockchain protocol of a network like Polkadot will connect different technological threads into a single economy and movement.

The ability to communicate without the need to trust each other is the cornerstone of the Polkadot system. The parachain auctions of Polkadot can truly build a democratic internet space as decentralized or distributed network architectures form the infrastructure of the online world.

In May this year, a Polkadot upgrade enabled parachain-to-parachain messaging over XCM. The XCM format is aimed at helping the Polkadot network become a fully interoperable multichain ecosystem. XCM allows communication not only between the parachains themselves but also between smart contracts and decentralized applications.

As a blockchain running on the PoS consensus mechanism, Polkadot is one of the most eco-friendly blockchain cryptocurrencies.

The PoS method is more sustainable than the PoW method as there is no race to mint more coins.

As per a new study by the Traders of Crypto, Polkadot, along with Cardano and Algorand, are among the most environment-friendly cryptocurrencies. With annual CO2 emissions of 50 tonnes, Polkadot is the fourth most eco-friendly cryptocurrency.

For eco-conscious investors, Polkadot has remained the preferred option for years and continues to be.

The ongoing Russia-Ukraine conflict had a devastating effect on the international community. The crisis abetted the crash of the cryptocurrency industry but industry leaders and hundreds of others nonetheless came together to support Ukraine in her moment of vulnerability. In May 2022, Polkadot co-founder Gavin Wood donated 298,367 DOT worth $5.8 million to Ukraine.

The contribution of the crypto community has also been acknowledged by Mykhailo Fedorov, Vice Prime Minister of Ukraine. On 17 August 2022, he tweeted that $54 million from these funds has been spent on military gear, including rifle scopes, vests, helmets, and tactical backpacks.

A Forbes report quotes Bilal Hammoud, CEO, and founder of National Digital Asset Exchange, “Polkadot’s mission is to securely allow Bitcoin and Ethereum to interact with each other in a scalable manner… Imagine if you store your wealth in Bitcoin and use that Bitcoin on an Ethereum dApp [decentralized application] to take out a loan for a house quickly and securely.”

The interoperability and scalability of the Polkadot infrastructure have helped it endear itself to a lot of enthusiastic developers, thereby significantly raising the value of DOT.

Why these projections matter

Among all the market’s leading cryptocurrencies, what is peculiar to Polkadot is that it offers an opportunity to users to operate and transact across blockchains. With a circulating supply of over 1 billion coins, DOT is expected to remain one of the market’s most popular cryptos.

This also makes DOT one of the most closely observed cryptocurrencies in the market. Ergo, it is critical investors and holders remain aware of what popular analysts have to say about the future of DOT.

In this article, we will briefly summarize the key performance metrics of DOT such as price and market cap. Thereafter, we will observe what the most popular crypto-market analysts have to say about the current and future states of DOT, along with its Fear & Greed Index. We will also present metric charts to complement these observations.

Polkadot’s Price, Market Cap, and everything in between

Polkadot performed very well during the crypto-bloom of 2021, crossing the price level of $20 in early February and $30 in mid-February. It breached the $40-mark in early April and kept going up and down for the next few months. After going through a rough patch, it hit an ATH of $55 in early November.

The last month of 2021 was a difficult period of time for the entire cryptocurrency market. Things were no different for Polkadot, with DOT trading at just a little above $26 on 31 December.

Come 2022 and the Russia-Ukraine crisis further pushed the market into chaos. In January-February, DOT was trading at around $18-20. It was thought that the Ukrainian government’s decision in March to accept donations in DOT would improve its prospects. Alas, it hardly made any difference as it was only in early April that it crossed the price mark of $23.

In May 2022, the collapse of both LUNA and TerraUSD sent shockwaves across the entire cryptocurrency industry. In fact, on 12 May, DOT’s price plummeted to $7.32. June and July also remained dismal for the entire cryptocurrency market, with DOT dipping to as low as $6.09 on 13 July. The news of the Japanese crypto-exchange Bitbank listing Polkadot on its platform in early August brought some respite though.

Polkadot has also been scoring on other fronts. For instance, look no further than Messari’s latest report on the regenerative finance movements. According to Polkadot,

Pink is the new green

21 parachains [blockchains], 250+ dapps, 2500 nodes including 297 active validator nodes, and Polkadot remains the greenest blockchain. https://t.co/3V4FkMoIoC

— Polkadot (@Polkadot) August 12, 2022

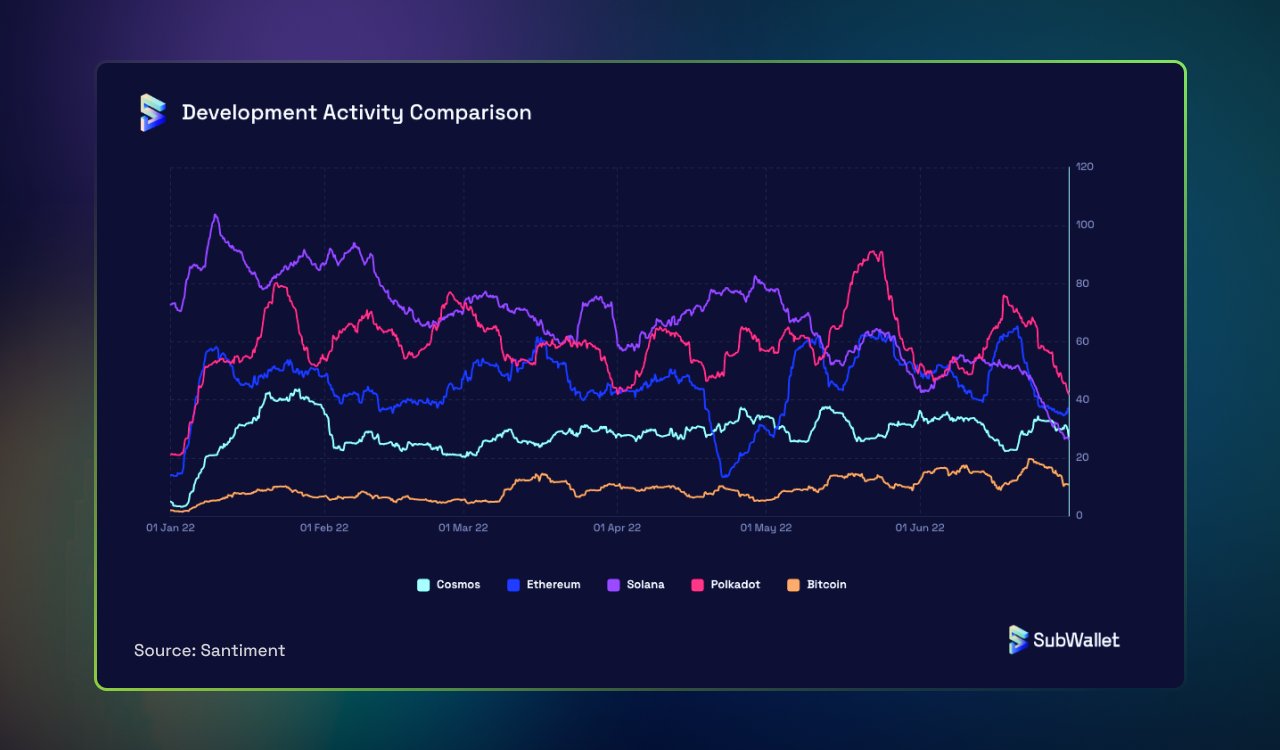

Similarly, developer activity has been positive for Polkadot too. In May and June, for instance, it had the highest dev count. Over the course of 2022, the same for Polkadot has been second only to Solana.

Source: SubWallet

Understandably, the market capitalization of Polkadot also mirrored the sentiment of the market. 2021 remained a blessed year for cryptocurrency, with its market cap soaring to nearly $45 billion in mid-May. However, the mayhem of the second quarter of 2022 crippled the Polkadot ecosystem. Nonetheless, Polkadot is the 13th largest cryptocurrency today with a market cap of a little less than $5.2 billion

Polkadot’s 2025 predictions

We must first understand that the predictions of different analysts and platforms can widely vary and predictions can more often than not be proven wrong. Different analysts focus on different sets of metrics to arrive at their conclusions and none of them can predict unforeseen political-economic factors impacting the market. Now that we have understood this, let’s look at how different analysts predict the future of Polkadot in 2025.

LongForecast predicts that DOT will open in 2025 with a price of $10.76 and will fall down to $9.38 by the end of March. In fact, the predictions platform also projected a 2025-high of over $13.5 on the charts.

The likes of Changelly, however, have been a little more optimistic in their projections. In fact, it argued that DOT will go as high as $39.85 on the charts, with the altcoin accruing a potential ROI of over 370%.

Similarly, South Africa’s Capex observed that as DOT attracts more attention and generates optimism in the market, its price will rise in the long term. Experts predict that DOT’s price will hit $10 by the end of 2022. It is also predicted that a new bull market could arrive and push DOT’s price to $15. The average DOT price in 2025, it argued, will sit at $15.82.

A Bloomberg news story published earlier this year revealed that according to a Crypto Carbon Ratings Institute study, Polkadot has the lowest total electricity consumption and total carbon emissions per year of the six so-called proof-of-stake blockchains. In fact, it only consumes 6.6 times the annual electricity consumption of an average American household.

Given the high-decibel conversations around the energy usage of cryptocurrencies, Polkadot’s energy efficiency is likely to attract the attention of customers.

Polkadot’s 2030 predictions

The aforementioned Changelly blog post argued that as per experts, Polkadot will be traded for at least $210.45 in 2030, with its maximum possible price being $247.46. Its average price in 2030 will be $218.02, it added.

According to Telegaon, on the other hand, DOT’s price in 2030 can go as high as $140.15 and as low as $121.79.

Capex also observed that as per fintech experts, DOT’s price is likely to increase steadily in 2030. It can easily climb as high as $35, it predicted.

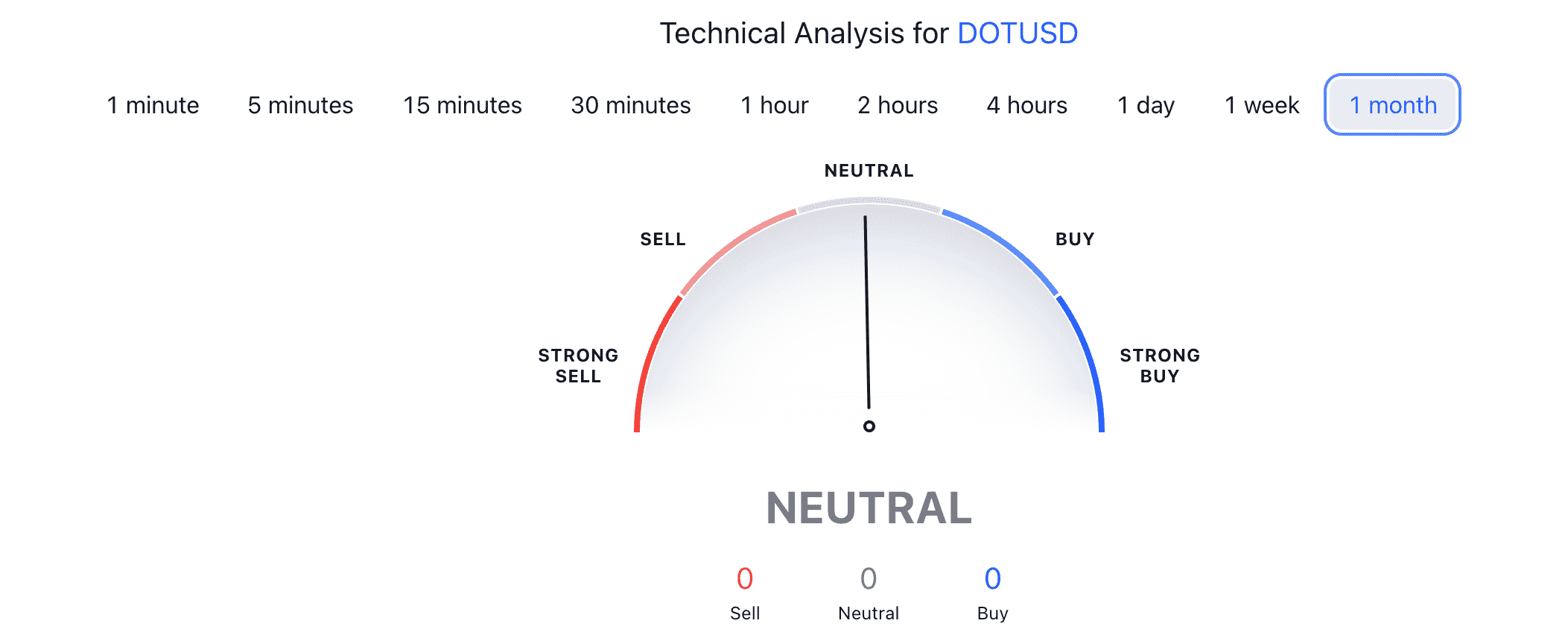

Here, it is worth highlighting that predicting a market 8 years down the line is difficult. Ergo, investors should conduct their own research before investing and be wary of caveats attached to popular projections. Especially since right now, despite DOT’s recent rallies, the technicals for the altcoin aren’t all bullish. In fact, safety first might be the best option right now.

Source: TradingView

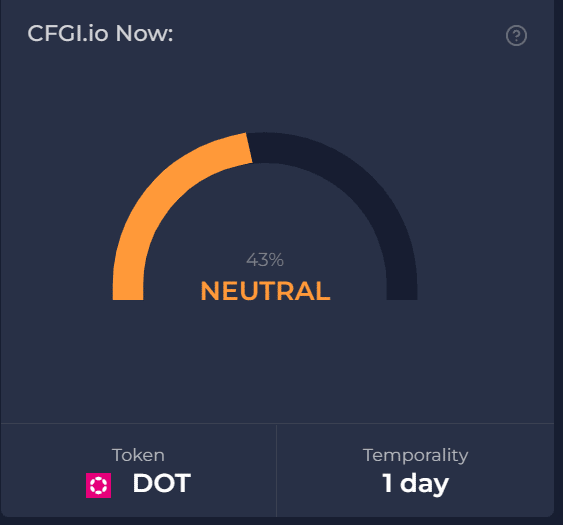

On the contrary, the Fear and Greed Index for Polkadot was flashing a ‘neutral’ signal, at press time.

Conclusion

Although DOT has witnessed bullish runs at intervals, its price movement remains very unpredictable. Though its announcement of it not being security elicited a positive market reception, it didn’t last long due to the ongoing squabble regarding FTX. Investors should be alert for any sudden changes in attitude, though the market is still unpredictable.

In comparison to other blockchains, Polkadot offers more power to its token holders, such as the roles of nominators, collators, and fishermen, besides that of validators. In short, DOT holders can not only mine the currency but be active participants in the blockchain in other capacities as well. This feature puts Polkadot above other PoS blockchains in the race.

Over the years, Polkadot has attracted investments from a number of venture organizations such as Arrington ARP Capital, BlockAsset Ventures, Blockchain Capital, and CoinFund. At one point in time, even Three Arrows Capital had also invested a significant amount in the venture.

An ambitious venture, Polkadot intends to compete with Ethereum. Though its interoperability has the potential to attract a lot of projects, only a small number of them have come aboard the network. Notwithstanding the reputation of Ethereum, Polkadot is a relatively new venture and can perform better in upcoming years given it is able to attract larger projects. Its efficiency and scalability should come in handy in this endeavour.

Polkadot limits the number of parachains it can support to around 100. Since the supply is limited, parachains are allocated through auction, governance system or parachains.

Only recently, the Kylin network became the winner of the 25th parachain auction on the Polkadot network, making a huge stride in the direction of Web 3.0 and DeFi development. Kylin won the offer with a bid of around 150,000 DOT.

The Web3 Foundation even today uses the proceeds from the sale of DOT tokens to support initiatives and projects being built on the Polkadot network. This foundation is governed by the Foundation Council, consisting of Dr. Gavin Wood, Founder-President, Vice President Dr. Aeron Buchanan and Reto Trinkler. The support provided to the network by such a reputed organization speaks volumes about the trust put in the future of the Polkadot blockchain network.

Only recently, Web3 Foundation, in association with the online education platform edX, launched a course on cryptocurrency, Web3, blockchain technology, and Polkadot. “It’s extremely important that we continue to provide key knowledge around the fundamentals of both Web3 technology and the Polkadot network to help guide the next generation of talented builders, developers, and entrepreneurs in the blockchain sector,” said Bertrand Perez, CEO of Web3 Foundation.

A few days back, the KILT Protocol created history by becoming the first parachain to accomplish a full migration from the Kusama Relay Chain to the Polkadot Relay Chain. In cases where the stability and bank-level security of Polkadot is integral to a parachain’s ultimate design and purpose, Kusama is very beneficial as an initial development environment that presents an upgrade path to Polkadot.

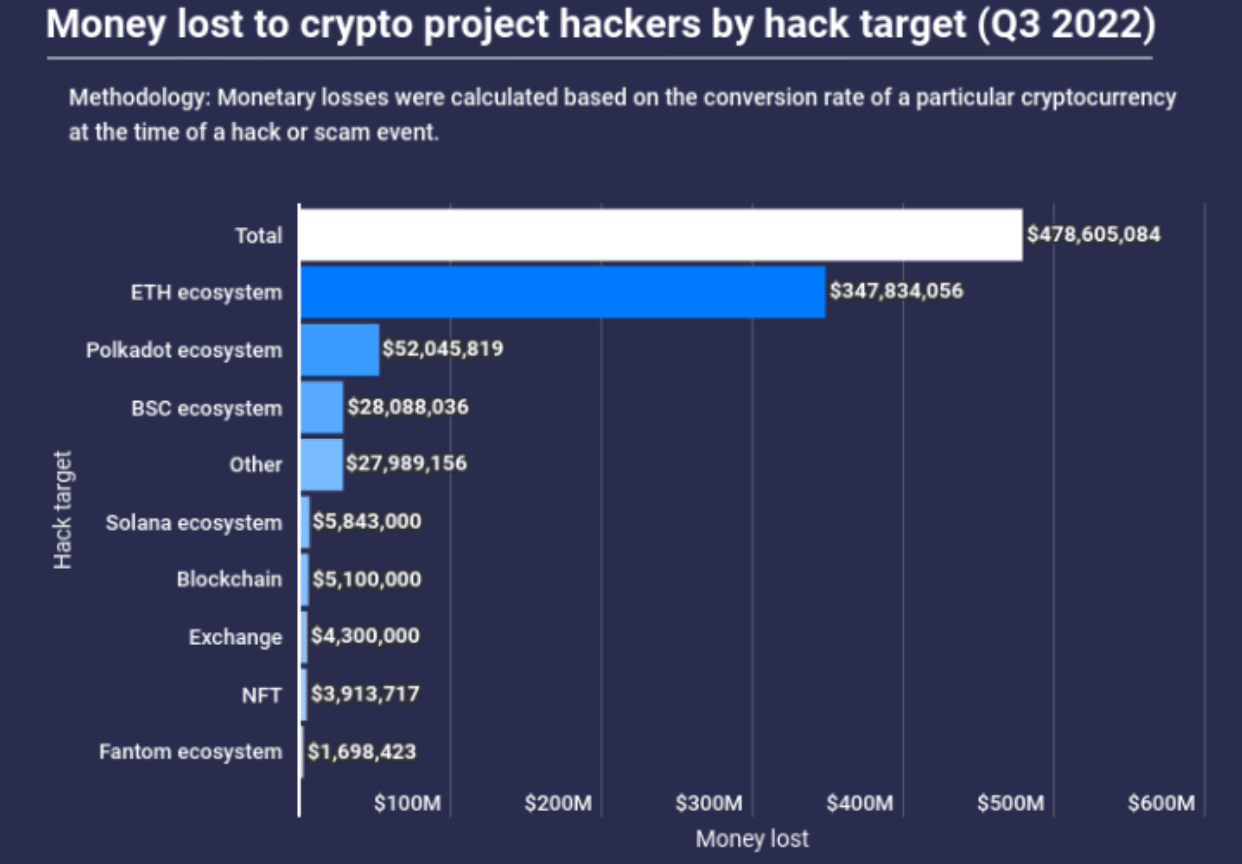

Security on the Polkadot ecosystem remains a concern for investors. A blockchain security firm named Slowmist recently published a finding that over $52 million worth of cryptocurrency was hacked over the Polkadot ecosystem in Q3 2022.

“If you are new to the [cryptocurrency] space, you have to invest your time reading and investigating the projects you are interested in,” Hammoud advised. “Remember that the space is young, and there are many opportunities to learn and make the right investment decisions.”

Source: Slowmist

It must be reiterated, however, that predictions aren’t set in stone and due caution should be taken by investors before investing in the market.

Investors continue to remain concerned about the security of the Polkadot ecosystem. Slowmist, a blockchain security firm, recently revealed that over $52 million in cryptocurrency was hacked in the Polkadot ecosystem in the third quarter of 2022.

Polkadot (DOT) bulls were able to pounce and invalidate the trend after a bearish dominance. Its price has increased by 6% in the last two days. The trend indicates that market volatility is increasing. As the market price fluctuates toward the top range, this market mood is likely to persist.

Two days ago, Polkadot revealed in its newsletter some important developments that occurred in its ecosystem. The updates encompassed several domains, including governance highlights, ecosystem updates, and newly launched videos. Polkadot Insider, a popular Twitter account that posts updates related to the Polkadot ecosystem, also revealed an interesting statistic. As per the tweet, Polkadot surpassed Solana in terms of development activity. Not only that, but the ecosystem ranked third on the list of the top blockchains by projects.

Polkadot Insider recently shared on Twitter that the network remained on the top of the Nakamoto Coefficient hierarchy. At the time of writing, Polkadot was far above Avalanche [AVAX], Solana [SOL] and Cosmos [ATOM]. A high Nakamoto Coefficient provides security for crypto networks against manipulation. With the Coefficient at 62, it meant Polkadot validators were actively ensuring full blockchain functionally while obstructing network compromise.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Stellar

Stellar  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Bittensor

Bittensor  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Internet Computer

Internet Computer  OKB

OKB  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Cronos

Cronos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jito Staked SOL

Jito Staked SOL  Ondo

Ondo  Ethereum Classic

Ethereum Classic