Amid arguably the coldest winter in Bitcoin’s history, its price has fallen by more than 70% from its Nov. 10, 2021, all-time high of $69,044.77, while its market cap is down to $318.943 billion from the yearly high of $902.04 billion — a 64.64% decline.

Let’s take a look at some metrics that can provide more insight into the current Bitcoin bear market:

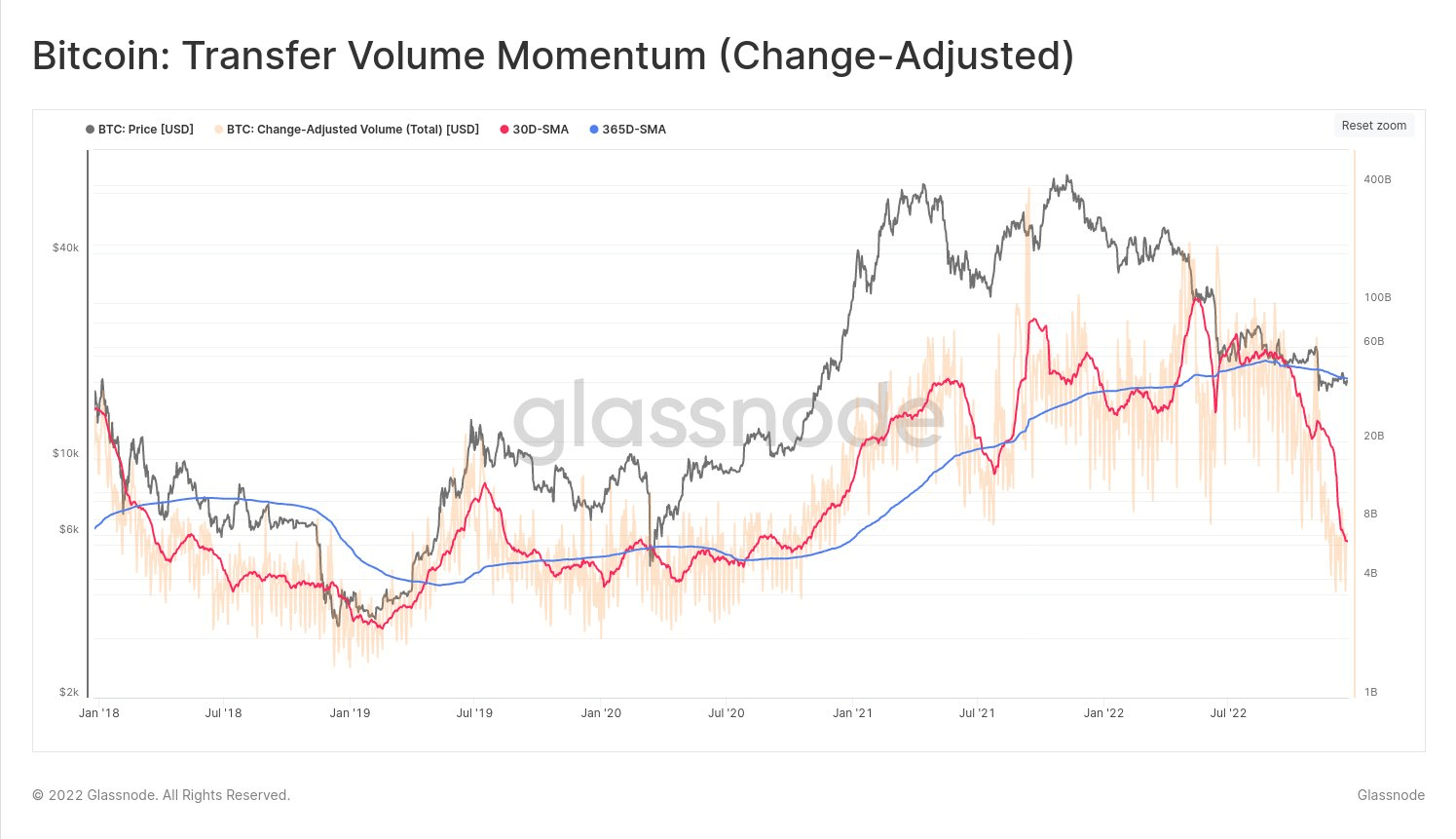

Transfer Volume Momentum

Before June, the 30-day Moving average (DMA) (red line) transfer volume in BTC reached new highs, but after the Luna-Terra crash, it rapidly declined and now stands at new lows.

Transfer volume on the Bitcoin network provides an indication of the current level of network activity and the value that is being transferred in BTC and USD. This metric compares the monthly average (red line) transfer volume against the yearly average (blue line) to underline relative shifts in dominant sentiment and help identify when the tides are turning for network activity.

It is typical for the 30DMA to be below the 365 DMA during bear markets and vice versa during bull markets. Currently, the 30 DMA has fallen below the 365 DMA, indicative of declining network fundamentals and declining network utilization, according to data analyzed by CryptoSlate.

This indicates that momentum has evaporated in terms of chain transfer, which is concerning. It is also the largest discrepancy between the 30 DMA and the 365 DMA in over the last five years.

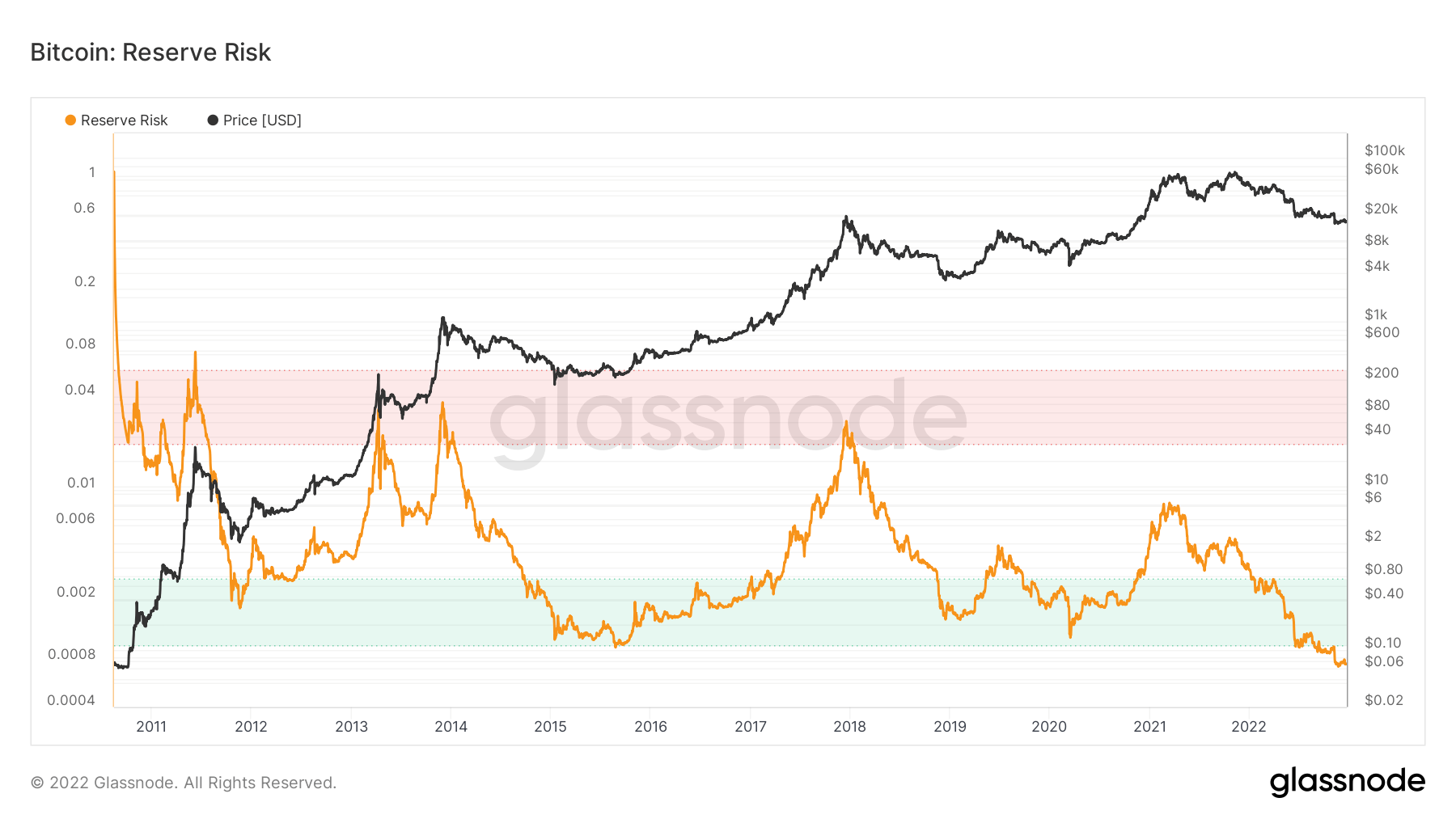

Bitcoin Reserve Risk

CryptoSlate’s on-chain analysis shows the Bitcoin Reserve Risk indicator has declined to an all-time low.

The Bitcoin Reserve indicator gauges the confidence level of long-term holders relative to the current bitcoin price. Reserve Risk is the ratio between the current price (incentive to sell) and HODL Bank. The HODL Bank metric represents the cumulative opportunity cost of holding the asset.

When Bitcoin prices reach record highs, Reserve Risk (the red zone) tends to be higher, reflecting a decrease in investor confidence.

Alternatively, a lower Bitcoin price and higher confidence mean lower Reserve Risk (the green zone) or an improved risk/reward ratio.

However, at current times, BTC reserve risk has fallen out of the green box for the first time in its history, showing a lack of confidence among investors.

Nevertheless, low Reserve Risk can signal relative undervaluation, which can be a lengthy and prolonged process.

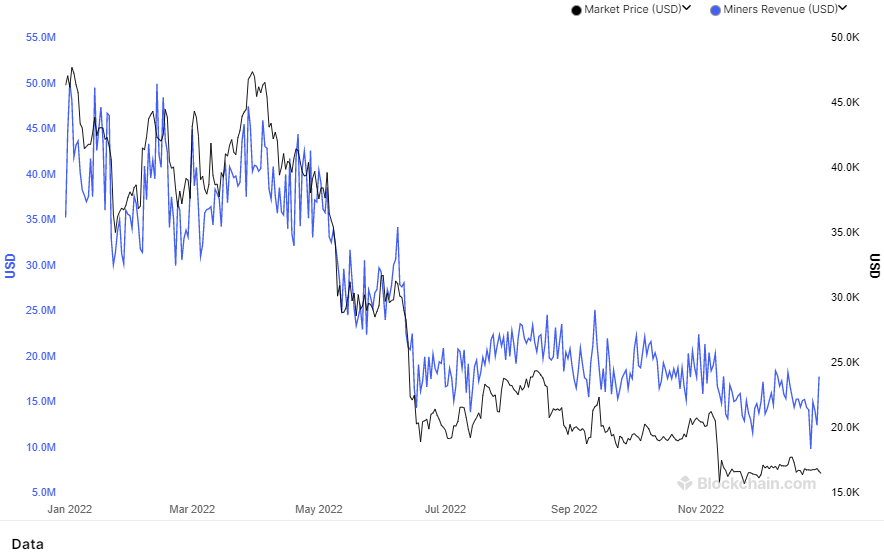

Bitcoin Miner’s Revenue

Bitcoin miners’ revenue per day declined over one year and fell to new lows due to a weak market and increasing computational demands.

As a result, mining firms such as Core Scientific have filed for bankruptcy, and multiple miners are also suffering. In addition, according to a previous report by CryptoSlate, miners are selling their coins at the highest rate in the last two years, resulting in difficulty being adjusted negatively moving forward.

Meanwhile, BTC miner wallet balances have dropped to levels seen in January 2022, according to data analyzed by CryptoSlate.

Mark Mobius, the co-founder of Mobius Capital Partners, who correctly predicted the drop to $20,000 this year, believes bitcoin is not far from $10,000 having broken the technical support levels of $17,000 and $18,000.

If Mobius’ $10,000 call comes true, it will add more misery to the cryptocurrency market.

However, Bitcoin sentiment is not entirely bearish in 2022. For instance, the number of long-term Bitcoin holders hit an all-time high this year.

Read More: cryptoslate.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Shiba Inu

Shiba Inu  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  LEO Token

LEO Token  Toncoin

Toncoin  Litecoin

Litecoin  Polkadot

Polkadot  WETH

WETH  Monero

Monero  USDS

USDS  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pi Network

Pi Network  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Aave

Aave  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  Dai

Dai  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  Ondo

Ondo  OKB

OKB  Internet Computer

Internet Computer  Cronos

Cronos  Ethereum Classic

Ethereum Classic  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund