Shares of popular video game and digital experience platform Roblox (NYSE:RBLX) have been on the retreat of late following another “perfect storm” of issues. Despite the latest surge of negative momentum, Roblox remains one of the most enticing long-term metaverse plays.

Indeed, the metaverse hype has faded in a major way over the past year. Firms like Meta Platforms (NASDAQ:META), committed to investing large sums in building digital worlds, have been met with relentless selling. There’s not much visibility as to what the “metaverse” will look like once it’s ready for the average consumer.

In any case, the metaverse remains a technological trend to keep tabs on, even as investors dismiss it because of the massive investment it entails. With little to no clarity on the type of reward to be expected from hefty capital expenditures, it’s unsurprising that investors would rather firms cut their forward-thinking investments.

Undoubtedly, the metaverse seems like an abstract moonshot of sorts. In a higher-interest-rate environment, the risks of such a project not taking off are much higher than if rates were hovering near zero. In such a high-rate world, expect less risk-taking on the part of tech companies, especially the smaller ones with smaller cash flows and suspect balance sheets. Such risk-taking could curb innovation and delay many technological trends investors grew excited about in 2021.

Despite the added stress on small- and mid-cap innovators, big tech remains financially healthy and more than willing to keep moving the puck forward, even as the masses call for cuts. Meta Platforms is still pushing ahead with its metaverse ambitions. If anything, higher rates seem to be a higher hurdle for unicorns and startups with sights set on the metaverse.

Roblox is a company that I view as a better metaverse play than Meta Platforms. Its platform is already quite mature and has stuck with younger audiences. Though the recent quarter and November 2022 metric release raised some red flags about the medium-term growth story, I remain bullish on the stock.

Roblox Stock Hit with Downgrades after Poor ABPDAU Figure

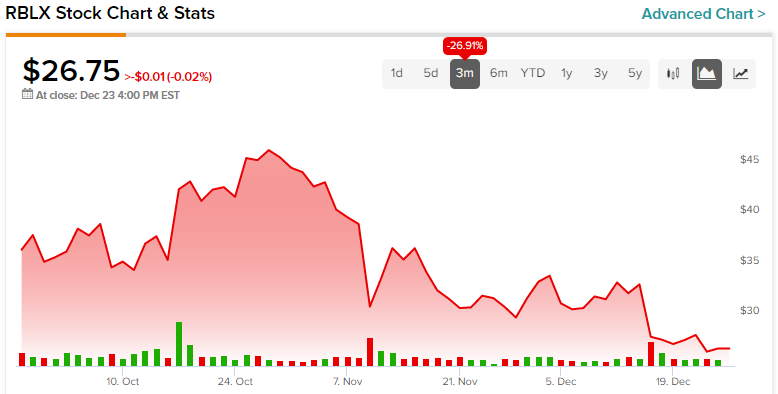

High-multiple growth stocks have, once again, felt the full force of the Fed’s interest rate hikes. With a third-quarter miss ($0.50 EPS loss vs. $0.32 loss estimate), recession jitters, and investor unwillingness to look too far into the future for profits, it’s not a mystery why Roblox stock finds itself in the gutter again at around $26 and change per share. The latest average bookings per daily active user (ABPDAU) report for November added more salt into the stock’s wound. Non-adjusted ABPDAU fell 7% to 9%, Roblox estimates, catching Wall Street off guard and helping induce a brutal plunge in the stock.

Following the underwhelming ABPDAU number, analysts quickly downgraded their RBLX stock price targets. Morgan Stanley (NYSE:MS) recently noted that the weak booking growth broke the reacceleration trend.

Indeed, Roblox’s booking numbers could remain under considerable pressure as we approach a recession. Consumer budgets are feeling the pinch right now, and things could get worse before they get any better as high inflation meets a global economic downturn. Beyond the recession, Roblox could be poised for a swift reacceleration as the firm looks to continue innovating with its platform.

Roblox is continuing to invest in its developers. Recession or not, its platform is becoming richer with experiences. As long as Roblox can keep engaging its users, the long-term growth profile still seems intact. In my mind, a recession is unlikely to mark the beginning of the end for the impressive video game platform.

Is Roblox Stock a Buy, According to Analysts?

Turning to Wall Street, RBLX stock comes in as a Hold. Out of 17 analyst ratings, there are seven Buys, six Holds, and four Sell recommendations.

The average Roblox price target is $36.56, implying upside potential of 36.7%. Analyst price targets range from a low of $19.00 per share to a high of $51.00 per share.

The Bottom Line on RBLX Stock

Roblox is one of the firms with a metaverse-like economy that’s been alive and well for many years. In that regard, I still view Roblox as a metaverse frontrunner and a candidate that could be quick to turn once we start talking about the metaverse again.

Indeed, investing in extremely forward-looking trends with rates on the rise is hard. As winds of recession eat into growth, many secular growers will be mistaken for firms on their way out. I’d group RBLX stock in the former camp. In the meantime, the stock will continue to feel the pressure of the harsh macro environment.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Polkadot

Polkadot  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  Hedera

Hedera  Litecoin

Litecoin  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Bittensor

Bittensor  Filecoin

Filecoin  Render

Render  Algorand

Algorand  Arbitrum

Arbitrum  Cosmos Hub

Cosmos Hub  Dai

Dai  Stacks

Stacks  Immutable

Immutable  WhiteBIT Coin

WhiteBIT Coin  Celestia

Celestia