The crypto market has been going through a bear phase for almost a year since it reached its all-time high in 2021. Since then, the prices of BTC, ETH, and all other altcoins have fallen anywhere between 50 to 90%.

If you’re among investors whose portfolio is down heavily, you might consider staking your crypto assets to earn staking rewards and weather the storm while waiting for the next bull run rather than selling them at a loss.

Polkadot (DOT) is down by more than 80 percent since its all-time high. You can check the Polkadot current price at Polkadot Price on CoinStats. Polkadot provides one of the best staking coins because it uses scalable, multi-chain technology and a variant of PoS called Nominated Proof-of-Stake (NPoS) consensus mechanism. Staking Polkadot enables you to become a validator within the Polkadot network and earn passive rewards for your efforts. Polkadot comes with an average annual return of 14%, which makes it among the best staking coins in the crypto market.

Read on to learn everything you need to know about Polkadot and how to earn staking Polkadot (DOT) to make the most of your crypto holdings.

Let’s get right to it!

Key Takeaways

- Polkadot is a sharded blockchain that connects multiple blockchains, facilitating the exchange of data and value between previously incompatible networks (i.e., Bitcoin and Ethereum) in a trustless way.

- DOT is the Polkadot blockchain’s native cryptocurrency used to pay transaction fees and earn rewards.

- Polkadot comes with an average annual return of 14%, which makes it among the best staking coins in the crypto market

What Is Polkadot?

Polkadot is a next-generation sharded Layer 1 blockchain that connects multiple blockchains, facilitating the exchange of data and value between previously incompatible networks (i.e., Bitcoin and Ethereum) in a trustless way. The Polkadot network is secure, scalable, decentralized, and multi-chain. Its innovative concepts for scalability, interoperability, governance and blockchain code update have earned Polkadot the nickname the “Ethereum killer.”

Polkadot aims to create a decentralized web, granting users complete control and delivering an interoperability protocol that uses shards to scale the Network. It connects blockchains facilitating a new form of the web where independent blockchains can exchange data and value in a trustless way.

Polkadot is designed to sustain all three distinguishing traits of blockchains – decentralization, speed, and security in a trustless environment.

The Polkadot blockchain’s native DOT token is used for staking and governance.

The Polkadot whitepaper was released in 2016 by Dr. Gavin Wood, the Ethereum co-founder and the inventor of the Solidity smart contract language. Dr. Gavin Wood, Peter Czaban, and Robert Habermeier founded the Web 3 Foundation in Switzerland in 2017, with Polkadot being its flagship protocol. The DOT tokens were sold through the first ICO in 2017 and a second ICO in 2020.

What Is Staking?

Now that we know what the Polkadot network is let’s look into staking. Blockchains use a consensus mechanism to verify data and transactions on the blockchain network. Proof-of-Work (PoW) and Proof-of-Stake (PoS) are two of the most prevalent consensus mechanism algorithms, each of which works on different principles.

In a Proof-of-Work blockchain, transactions and data are verified using a method called mining, in which miners have to solve complex mathematical problems to verify and process transactions and add them as a new block in the blockchain. The PoW mechanism of verifying transactions on the blockchain is robust and secure but also energy inefficient and causes scalability issues by hindering the number of transactions that can be processed by a blockchain simultaneously.

On the other hand, in a PoS consensus, a participant node is allocated the responsibility of maintaining the public Ledger in proportion to the number of virtual currency tokens it holds. On a Proof-of-Stake blockchain, the right to verify transactions is assigned to users randomly based on the number of tokens they have staked. So, holders of a required number of coins can earn staking rewards and participate in validation, i.e., verify transactions as needed. Participants staking their crypto in a PoS blockchain for an agreed-upon ‘staking period’ to provide value to the Network and earn rewards in return are called validators.

A Proof-of-Stake blockchain is less power-consuming and, therefore, solves scalability issues faced by a Proof-of-Work blockchain.

You can learn about staking in detail with our detailed guide, What Is Staking.

Staking only applies to blockchains that utilize the Proof-of-Stake (PoS) consensus mechanism to validate transactions. Users can stake cryptocurrency tokens on any staking platform of their choice. Most staking platforms are user-friendly and easy to use, so you can start staking on almost all major crypto exchanges, like Coinbase, Binance, etc., without prior experience.

How Does Staking Polkadot (DOT) Work?

The Polkadot blockchain deploys a Nominated Proof-of-Stake (NPoS) consensus mechanism that involves validators and nominators. Validators are the big stakers with a large number of DOT tokens and robust investment history on the blockchain. They are the ones who are up for nomination to validate a new transaction block, earning rewards in the process. A validator that doesn’t act by the Polkadot protocol and tries to verify a bad or fraudulent transaction or indulges in suspicious activities is penalized through slashing when they lose the DOT tokens they have staked. When staking Polkadot, it’s essential to stay up-to-date on the state of the chain and validator lists because you can lose DOT tokens if an incompetent validator doesn’t comply with the blockchain’s standards.

Nominators are the small stakers tasked with selecting validators for nominations. A nominator publishes a list of validator candidates they trust and stakes DOTs to support them. Nominators’ stakes are distributed amongst validators, and they earn a percentage of the block rewards validators earn. If some of these candidates are elected as validators, the nominator shares with them the payments based on the proportion of their DOT tokens.

The relationship between validators and nominators keeps the Polkadot blockchain running.

The rewards for staking Polkadot are distributed in the form of DOT tokens, with DOT rewards being as high as 21 percent, depending upon the chosen staking platform. There is a minimum staking requirement of 10 DOT tokens for staking Polkadot directly on the Network, and the amount varies depending on the staking platform.

Fast Fact

In an NPoS consensus mechanism, validators hold a large number of tokens and are nominated by token holders to validate transactions on the blockchain.

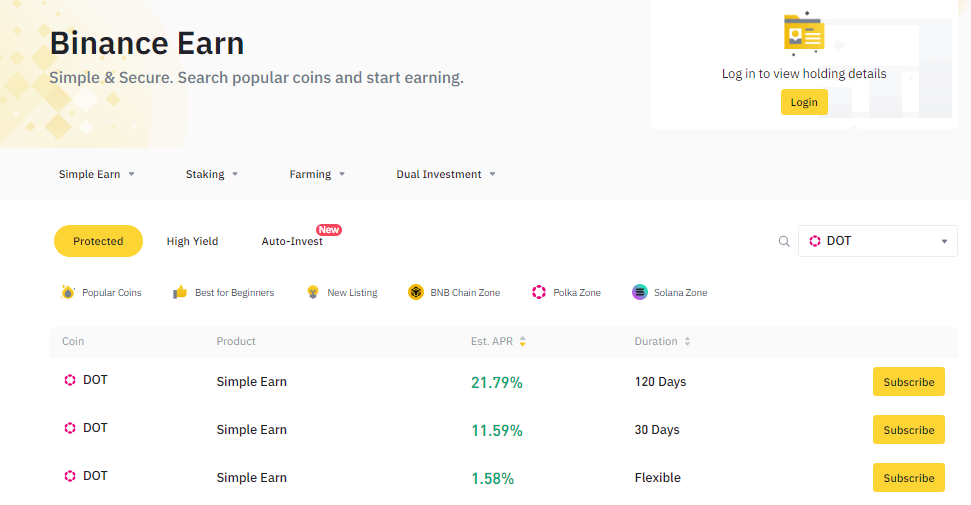

How to Stake Polkadot (DOT) on Binance?

Now that we have a very good understanding of how Polkadot staking works let’s get into staking Polkadot to start earning staking rewards. One of the best places for staking Polkadot is Binance, the world’s largest crypto exchange in terms of the trading volume. Follow the steps highlighted below to stake Polkadot on Binance.

1. Create a Binance Account

If you don’t have a Binance account, then the first step is creating an account on Binance. Binance, like many other cryptocurrency exchanges, offers a hassle-free registration with only an email address or valid mobile number. A link will be sent to your address or mobile phone, and you must click it to verify your account. Once the account is activated, you must create an elaborate password, and you’re good to go.

While Binance doesn’t have mandatory KYC and AML requirements, users must complete the KYC verification process to gain full access and increase higher deposits and withdrawal limits. You must provide personal information and a government-issued identity card to verify your account.

Once your identity verification is complete, it’s recommended to activate two-factor authentication (2FA) for an extra layer of security.

2. Buy or Deposit Polkadot

After setting up your account, the next step is to deposit Polkadot (DOT) into your Binance account. You must send Polkadot (DOT) from your cryptocurrency wallet to your Binance account. On the other hand, if you don’t own Polkadot (DOT) tokens, you can easily buy them on Binance using fiat currencies, credit or debit cards, bank transfers, or peer-to-peer transactions.

3. Stake Polkadot

Once you have the required amount of Polkadot(DOT) tokens in your Binance wallet, you’re all set to start your Polkadot staking. Go to Binance Earn and search for DOT. Choose among the options depending on the type of staking products, how much you’re willing to stake, and the lock-up period. While flexible staking is among the given options, its APR is low. In contrast, locked staking guarantees higher returns, but your DOT tokens will be locked up for the agreed-upon period.

Select the option that suits your needs, enter the amount of Polkadot (DOT) you want to stake, agree to the terms and conditions, and confirm the transaction.

Congratulations, you’ve successfully started staking Polkadot and receiving rewards. Your Spot Wallet is the rewards destination, and you can track them daily.

Polkadot Staking Using a Ledger Device

Ledger hardware wallet is one of the world’s best wallets for securely storing your assets. And the good news is you can now use the Ledger hardware wallet to stake Polkadot and earn rewards. Follow the steps described below to start staking Polkadot using a Ledger device.

Set up Your Ledger Device

- Connect your Ledger hardware wallet to your computer and unlock it using your PIN.

- Go to the Ledger Live app, allow Ledger Live on your Ledger device, and click the Earn rewards button.

- Click the Manager tab, search for Polkadot, and click Install.

- Click Polkadot JS and Manage Hardware Connections in Settings.

- Select Attach Ledger via WebUSB and click Save.

- On Polkadot JS, click Accounts and select Add via Ledger. This will open a pop-up where you must set up your Polkadot Account.

- Select an account type and index, as they’re used to define your address on the Polkadot blockchain. If you aren’t sure which one to choose, you can select the default (o/0).

- You can now find your Polkadot Ledger Account and its address at the bottom. Ensure that the Polkadot address on the hardware device is the same as the one on the Polkadot JS.

- Fund your Polkadot account with the amount of DOT tokens you want to stake. Deposit more than you wish to stake for paying transaction fees on the Polkadot blockchain.

- Now you’re all set to begin staking DOT and earn rewards using your Ledger wallet.

Staking DOT on Polkadot

Polkadot doesn’t support batch transactions, therefore, you must perform two transactions to stake DOT. Follow the steps described below to stake DOT on the Polkadot network.

- In your Polkadot Account, click Network and select staking.

- Click Account Actions and select +Stash. Choose the Ledger account as your Stash and Controller account.

- Choose an account for your rewards destination and click Next to bond your Polkadot tokens.

- Remember to leave more than 1.5 Polkadot tokens in your account and not bond them, as accounts with less than 1 DOT token are reaped. You also need DOT to pay the transaction fees.

- Click Bond, select Sign, and Submit.

- Confirm the transaction on your Ledger wallet to view it under Account Actions in the Staking section on Polkadot JS.

- Select as many as 16 validators and click Nominate. You can select all 16 validators, then click Nominate, Sign, and Submit the transaction.

- You have now successfully managed to stake Dot on Polkadot using your Ledger device.

Final Thoughts

In summary, staking DOT is one of the best ways to receive rewards, especially in a bear market when cryptocurrency prices are down historically. Moreover, it allows you to support the Polkadot project, aiming to provide a decentralized internet or web application for blockchain networks to communicate with each other. The Network provides information and transactions to be performed in a secure environment.

Consider choosing the Ledger hardware wallet for staking DOT to ensure the best security of your Polkadot investment.

Read More: coinstats.app

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Sui

Sui  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Pi Network

Pi Network  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Shiba Inu

Shiba Inu  Stellar

Stellar  Hedera

Hedera  Toncoin

Toncoin  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Litecoin

Litecoin  LEO Token

LEO Token  USDS

USDS  WETH

WETH  Monero

Monero  Pepe

Pepe  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Dai

Dai  Ondo

Ondo  Aave

Aave  OKB

OKB  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  VeChain

VeChain