- ETC was in a mild rally.

- It could break below its current support of $15.95.

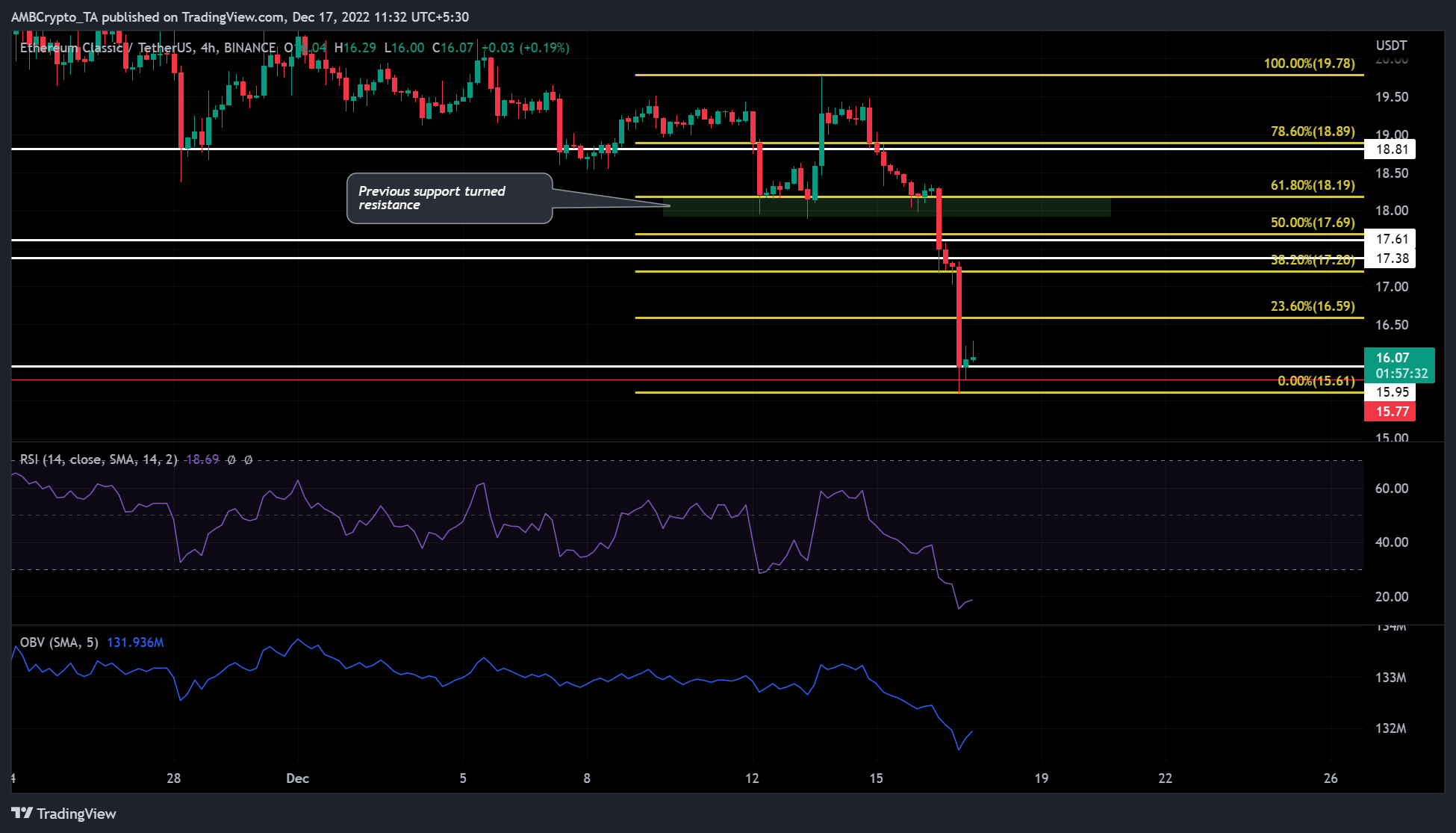

Ethereum Classic [ETC] attempted a rally but faced massive opposition from the bears. After flipping the critical support around the $18 mark into resistance, ETC broke additional supports as bears took control of the market.

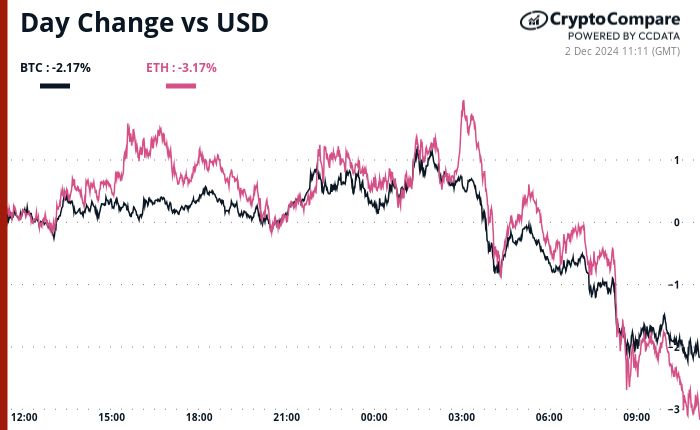

Technical indicators showed a price reversal to the upside was imminent in the short term. However, it may all depend on sentiment on BTC.

Notably, ETC fell below $18.24 after BTC dropped the $17.45K level. At press time, the altcoin traded at $16.07, down over 10% in the past 24 hours, with a BTC being bearish during the same period.

If a bearish BTC persists over the weekend, ETC could break below the current support at $15.95 and go lower to $15.61.

ETC recorded a shooting star pattern: will it drop lower?

At press time, ETC recorded a shooting star, the last green candlestick on the chart with a long tail wick. The long wick shows bulls pushed the price higher, but bears shelled it down, almost near $15.95 by the time of publication.

This shows ETC faced significant selling pressure that undermined an uptrend. As such, ETC could break below the current support at $15.95 and settle at $15.61.

Notably, the Relative Strength Index (RSI), at press time, was deep in the oversold area but retreated slightly. It showed that sellers had an advantage in the market despite buying pressure picking up. So, further selling pressure in the short term could push ETC downward, especially if BTC remains bearish.

However, the On Balance Volume (OBV) increased sharply, showing that trading volumes could boost an uptrend.

A strong uptrend, specifically if BTC is bullish, would push ETC above the 23.6% Fibonacci level of $16.59, invalidating the above bearish inclination. But bulls will only have an advantage if they clear the hurdle around the $18 mark.

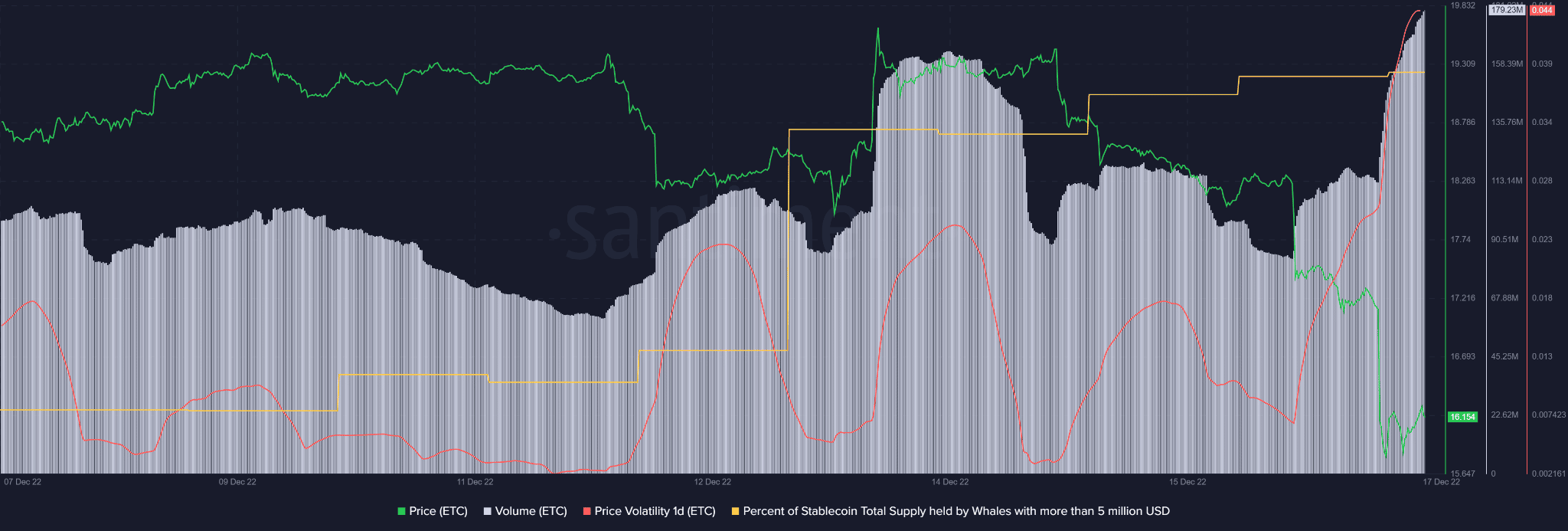

ETC saw increased volatility as whales took refuge in stablecoins

According to Santiment, ETC witnessed increased volatility pushing whales to seek refuge in stablecoins. Imperatively, the percentage of stablecoins held by whales increased as the volatility went up. This implied that whales were selling off their holdings, including ETC holdings.

It shows a bearish sentiment on ETC that could further sustain selling pressure. However, a bullish BTC will likely boost ETC bulls, negating the above bearish forecast.

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Polkadot

Polkadot  Wrapped Bitcoin

Wrapped Bitcoin  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Litecoin

Litecoin  Sui

Sui  Pepe

Pepe  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Internet Computer

Internet Computer  USDS

USDS  POL (ex-MATIC)

POL (ex-MATIC)  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Filecoin

Filecoin  Algorand

Algorand  Bittensor

Bittensor  Render

Render  Arbitrum

Arbitrum  Cosmos Hub

Cosmos Hub  Aave

Aave  Dai

Dai  Stacks

Stacks  WhiteBIT Coin

WhiteBIT Coin  Immutable

Immutable