Key Takeaways

- Grayscale is the largest Bitcoin fund in the world

- Discount to underlying asset (Bitcoin) has reached record levels, breaching 50%

- Concern about reserves, higher fees and other hurdles explain the discount, which likely won’t close anytime soon

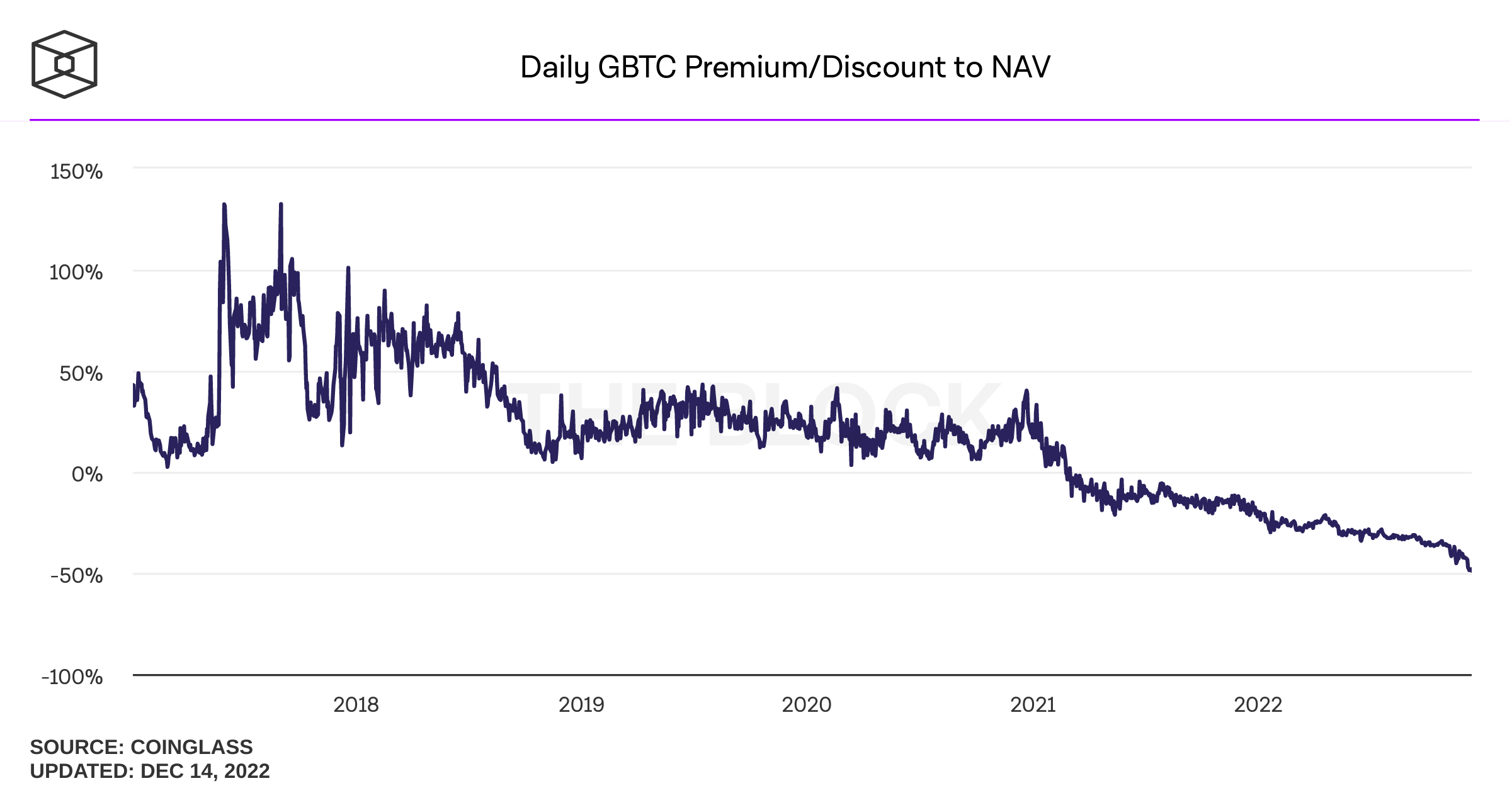

The discount to net asset value of the Grayscale Bitcoin trust is at all-time highs. The discount briefly pushed past 50%, before pulling back slightly to where it currently sits at 48.8%.

This comes off the back of the SEC reaffirming its reasons for denying Grayscale’s application to convert the trust into an exchange-traded fund.

The Grayscale Bitcoin Trust is the largest Bitcoin fund in the world, but it has rarely traded at the same level as its underlying asset, Bitcoin. The above chart shows that it had, until this year, traded at a premium since its launch compared to Bitcoin.

This fund allows accredited investors to gain exposure to Bitcoin without worrying about storing or managing their holdings. It previously traded at a premium as demand for shares surged, with institutions wanting Bitcoin exposure. This convenience does come at a fee, however – and a rather hefty one at 2%.

Demand falls for Grayscale in 2022

Since March, the Grayscale shares have been trading at a discount to Bitcoin. The fund has $10.7 billion in assets under management, a stark 65% fall in the last year, reflecting the bloodbath in the crypto markets.

But the discount to Bitcoin means shareholders are getting hit twice as hard.

“The fact that Grayscale’s Bitcoin Trust is now trading at nearly 50% discount is just awful for holders of GBTC. It really highlights the vast differences in structure quality between different investment vehicles,” Bradley Duke, co-CEO at ETC Group, told CoinDesk last week.

A decline in inflows has been borne out of greater competition as many competitive funds have launched, especially in Europe, as well as multiple filings for Bitcoin ETFs in the US. The discount is also because investors have no way to redeem their holdings for Bitcoin in the trust, but all the while are being charged a 2% fee.

However, these factors have typically been dulled by arbitrage traders taking advantage of the dichotomy in prices. But happenings this year have reduced that, too.

Concern about Grayscale’s reserves

Over the last month, concern has swelled in the market that Grayscale’s parent company, Digital Currency Group (DCG) may file for bankruptcy. This is due to the issues surrounding crypto broker Genesis, whose parent company is also DCG.

Genesis have denied they will imminently file for bankruptcy, but the firm was caught up in the FTX collapse and is currently undergoing restructuring. Genesis halted withdrawals on November 15th.

This concern has been elevated by questions around Grayscale’s reserves. Namely, whether they are true to their word and are holding all the underlying Bitcoin securely. With many major crypto companies publishing proof of reserves in the aftermath of the FTX crisis in order to assuage customer fear, Gray scale refused.

“Due to security concerns, we do not make such on-chain wallet information and confirmation data publicly available through a cryptographic Proof-of-Reserve, or other advanced cryptographic accounting procedure,” Grayscale wrote in a statement.

7) We know the preceding point in particular will be a disappointment to some, but panic sparked by others is not a good enough reason to circumvent complex security arrangements that have kept our investors’ assets safe for years.

— Grayscale (@Grayscale) November 18, 2022

As I wrote at the time, I really can’t fathom how security concerns are a factor here. The blockchain is built so that this kind of information is available to the public.

Below is really confusing from @Grayscale

Would love elaboration beyond just “security”

Does anyone have suggestions as to how revealing on chain wallet could be a security concern?

Only thing I can think of is quantum concerns (p2pk) but I don’t think that holds here? https://t.co/0QcVO6wV1x

— Dan Ashmore (@DanniiAshmore) November 19, 2022

Final thoughts

All in all, the discount sums up investors’ concern around Grayscale, as well as the extra fees and other hurdles which exist compared to owning the underlying. Arbitrage trades are self-destructive by nature, and hence it is notable that the discount is so large and has persisted for so long.

Then again, there is risk here, as the same thing which I have been writing about for a while now – a lack of transparency – means that it cannot be known for 100% certainty what is going on behind the scenes. And that is why we are seeing a 50% discount.

The post Why has the Grayscale Bitcoin Trust discount hit an all-time high? appeared first on CoinJournal.

Read More: bitcoinwarrior.net

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Aave

Aave  Uniswap

Uniswap  Bittensor

Bittensor  Cronos

Cronos  OKB

OKB  Ethena Staked USDe

Ethena Staked USDe  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  Ethereum Classic

Ethereum Classic