- BTC whales have intensified accumulation in the last few weeks.

- While selling pressure has reduced, buying momentum has not been enough to drive up prices.

Following the significantly bullish cycle between 2020 and 2021 that caused Bitcoin [BTC] to record an all-time of $60,000, the severe bearishness that has plagued the year so far caused BTC whales to reduce their supply, further drawing down the value of the leading coin.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

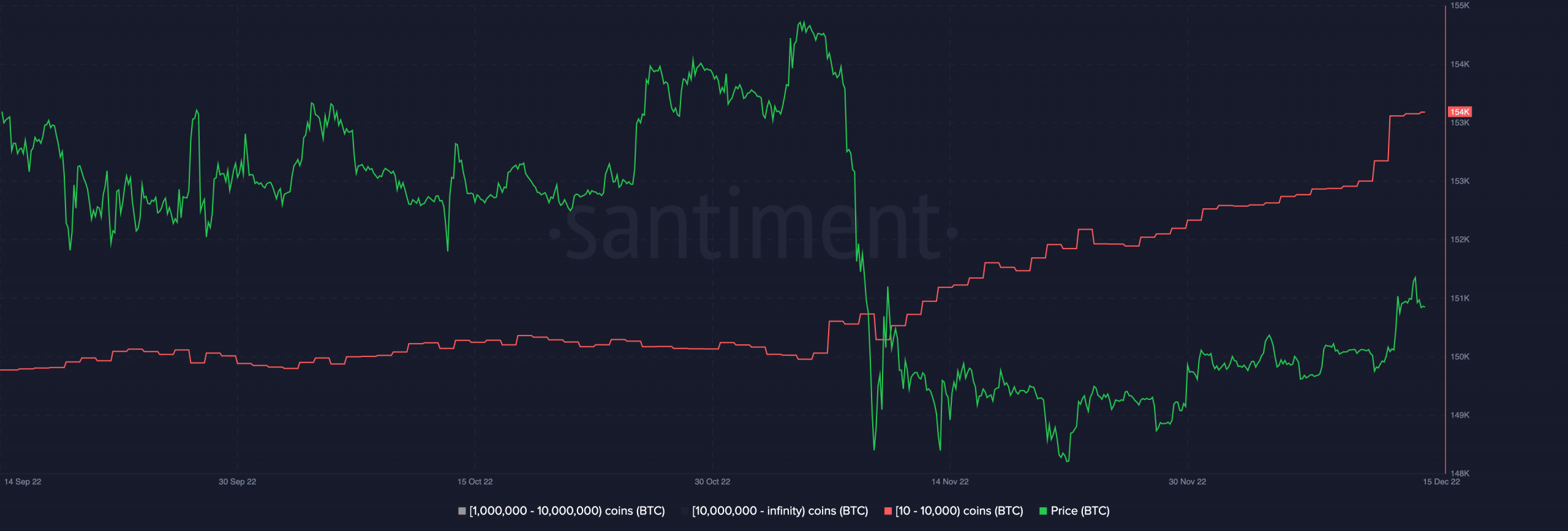

However, a change in sentiment amongst BTC whales has been spotted as this cohort of holders intensified accumulation in the past few months, data from Santiment revealed.

According to the on-chain analytics platform, in the past 10 days, BTC addresses holding between 100 to 10,000 BTC scooped up 40,747BTC worth over $726 million.

Additionally, the number of new addresses holding between 100 to 10,000 BTC has increased rapidly over the past three weeks (159 new addresses). This represents the fastest growth in this category of addresses in 10 months, which coincides with increased uncertainty and fear (FUD) following the announcement of the Russia-Ukraine war.

Is relief coming?

CryptoQuant analyst MAC_D assessed BTC’s Spent Output Value Bands and found that coin distribution momentum was declining.

MAC_D found that the series of events in the last month, like the collapse of FTX and miners’ capitulation, all of which should have led to a prolonged decline in BTC’s price, only impacted the king coin’s price momentarily, after which it rebounded. MAC_D noted,

“There have been several crises in the Crypto market this year, but the amount of whale deposits on the exchange is decreasing. The FTX crisis was much more serious than the LUNA crisis, but the decline was a short time and a small drop. Miner Crisis, which could be the next, could lower BTC prices, but it is not expected to cause major panic sells,”

While agreeing that FUD still lingered in the market, MAC_D stated,

“Because the number of long-term holders has increased, it is likely to be a boring and long decline rather than a strong panic sell.”

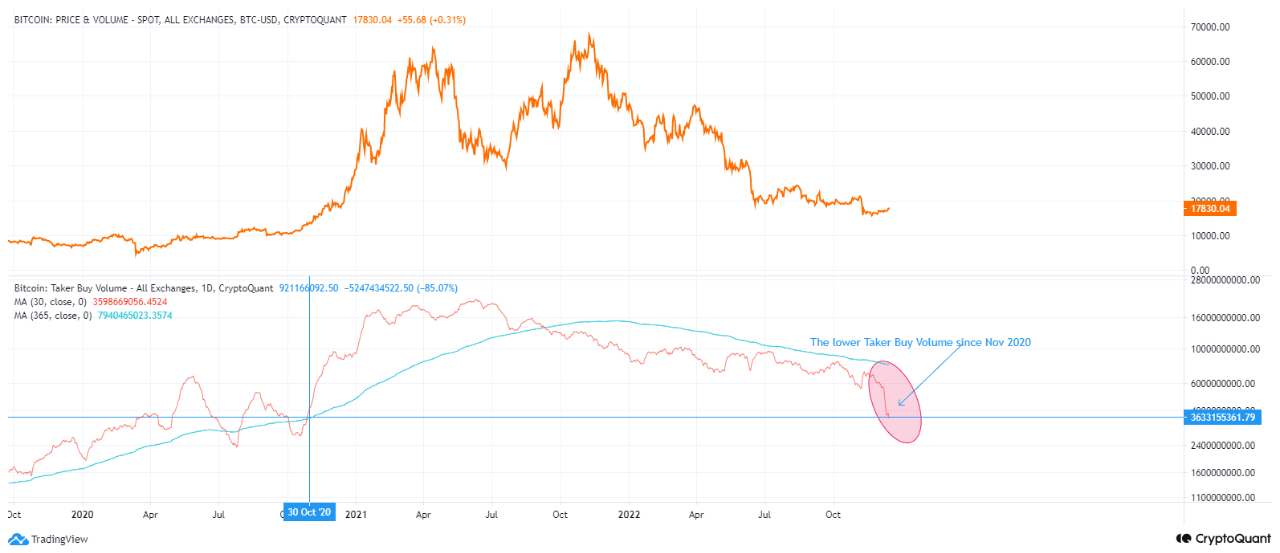

While selling pressure might have dropped and whale accumulation intensifying, BTC’s Buy Volume recently clinched its lowest level since November 2020. The growth in BTC’s Buy Volume momentum usually precedes an eventual uptrend in its price.

However, per CryptoQuant analyst, Ghoddusifar BTC’s “buy volume is still downward. and has reached its lowest level since November 2020.”

Projecting a further decline in BTC’s price, Ghoddusifar concluded that “we still cannot see a sign of a change in the trend.”

Read More: ambcrypto.com

![Bitcoin [BTC]: Slowed selling pressure, yes, but what about buying pressure?](https://ambcrypto.com/wp-content/uploads/2022/12/shubham-s-web3-V0f8N73V4To-unsplash-1-1000x600.jpg)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Toncoin

Toncoin  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Hedera

Hedera  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  Render

Render  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Arbitrum

Arbitrum  Filecoin

Filecoin  Celestia

Celestia  Dai

Dai  Algorand

Algorand  Stacks

Stacks  Bonk

Bonk  WhiteBIT Coin

WhiteBIT Coin  Cosmos Hub

Cosmos Hub