The recent drop in Ethereum ETH/USD price will have a cascading effect on decentralized finance (DeFi) platforms, as investors are ready to liquidate their ETH holdings In the wake of the FTX FTT/USD fallout.

What Happened: According to TVL aggregator DeFiLama, over 115,500 ETH are ready to be liquidated if the price reaches $718.72. This means $83 million will be liquidated around the $720 mark.

The available data points to DeFi platforms MakerDAO and AAVE as the biggest targets.

See More: Best Cryptocurrency to hedge against inflation

This comes as a whale holding 720,000 ETH, $817 million has woken up after two years of being dormant, according to an on-chain analytics report by Lookonchain.

On Monday, the hacker moved over 180,000 Ethereum to 12 new wallets, evenly distributing 15,000 ETH to each wallet, data from Etherscan showed. The hacker behind the FTX exploit has been spotted yet again trying to move the funds to several wallets, in the hopes of liquidating them.

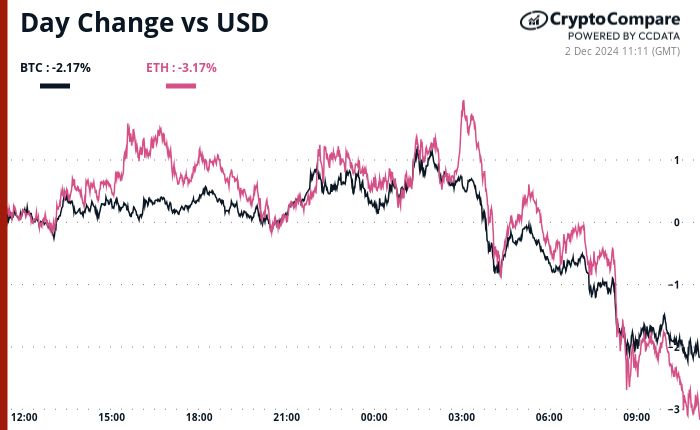

Price Action: At the time of writing, ETH was trading at $1,100, down 1.81% in the last 24 hours, according to Benzinga Pro.

Read Next: Bitcoin, Ethereum, Dogecoin Fall: Analyst Says ‘More Blood Yet To Come’ As Genesis Crisis Adds To Crypto Carnage

Read More: news.google.com

APF coin

APF coin  Access Protocol

Access Protocol  Orchid Protocol

Orchid Protocol  Euler

Euler  WHY

WHY  DOLA

DOLA  Uquid Coin

Uquid Coin  Bifrost

Bifrost  OORT

OORT  Shadow Token

Shadow Token  Dione

Dione  Victoria VR

Victoria VR  OMG Network

OMG Network  Rifampicin

Rifampicin  MESSIER

MESSIER  McDull (Meme)

McDull (Meme)  Sidus

Sidus  MemeFi

MemeFi  Anvil

Anvil  Dasha

Dasha  The Root Network

The Root Network  crvUSD

crvUSD  Forta

Forta  COCO COIN

COCO COIN  ArbDoge AI

ArbDoge AI  Ethernity Chain

Ethernity Chain  Parcl

Parcl  MOO DENG

MOO DENG  Empyreal

Empyreal  Aergo

Aergo  YES Money

YES Money  USDX

USDX  Aavegotchi

Aavegotchi  Litentry

Litentry  Dimitra

Dimitra  Heroes of Mavia

Heroes of Mavia  BUSD

BUSD  MAGA

MAGA  Tribal Token

Tribal Token  Metadium

Metadium  The Doge NFT

The Doge NFT  INSURANCE

INSURANCE  Dego Finance

Dego Finance  Onyxcoin

Onyxcoin  ChainSwap

ChainSwap  Keyboard Cat (Base)

Keyboard Cat (Base)  Gemini Dollar

Gemini Dollar