[ad_1]

Dear Bankless Nation,

The SEC offensive against crypto has undoubtedly left plenty of crypto investors, particularly newer ones, taking a look at the health and resiliency of their portfolios.

Today, we offer up some strategies on making sure your crypto bets are diversified.

– Bankless team

Bankless Writer: Donovan Choy

Crypto is one of the few asset classes where retail investor can net life-changing returns within a very short period of time.

Unfortunately, it’s also the one asset class that is subject to so much regulatory FUD. The recent SEC crackdown on the industry showcases that. This lack of predictability means crypto investors should not consider themselves exempt from balancing their bets.

Here are eight classic Bankless strategies to diversify your crypto portfolio. The first three are open to all but you have to be a premium subscriber to read the rest

#1 Liquid staking tokens

It’s hard to go wrong with liquid staking tokens AKA liquid staking derivatives (LSDs). LSDs are a user-friendly way for crypto investors to participate in securing the underlying L1 blockchain and earn rewards without going through the technical process of setting up a node.

For years, many feared that staking ETH on the Beacon chain was risky as developers had not yet enabled ETH withdrawals. This changed with the Shapella network upgrade in April 2023 where withdrawals were successfully enabled.

Right now, you can stake ETH on liquid staking protocols like Rocket Pool for APY rewards of 6.86%, or Lido for 4.2%. Alternatively, you can invest in an ETF-like index token composed of a range of liquid staking tokens. Popular options include the Gitcoin Staked ETH Index (gtcETH) or the Diversified Staked Ethereum Index (dsETH).

#2 Stablecoin diversification

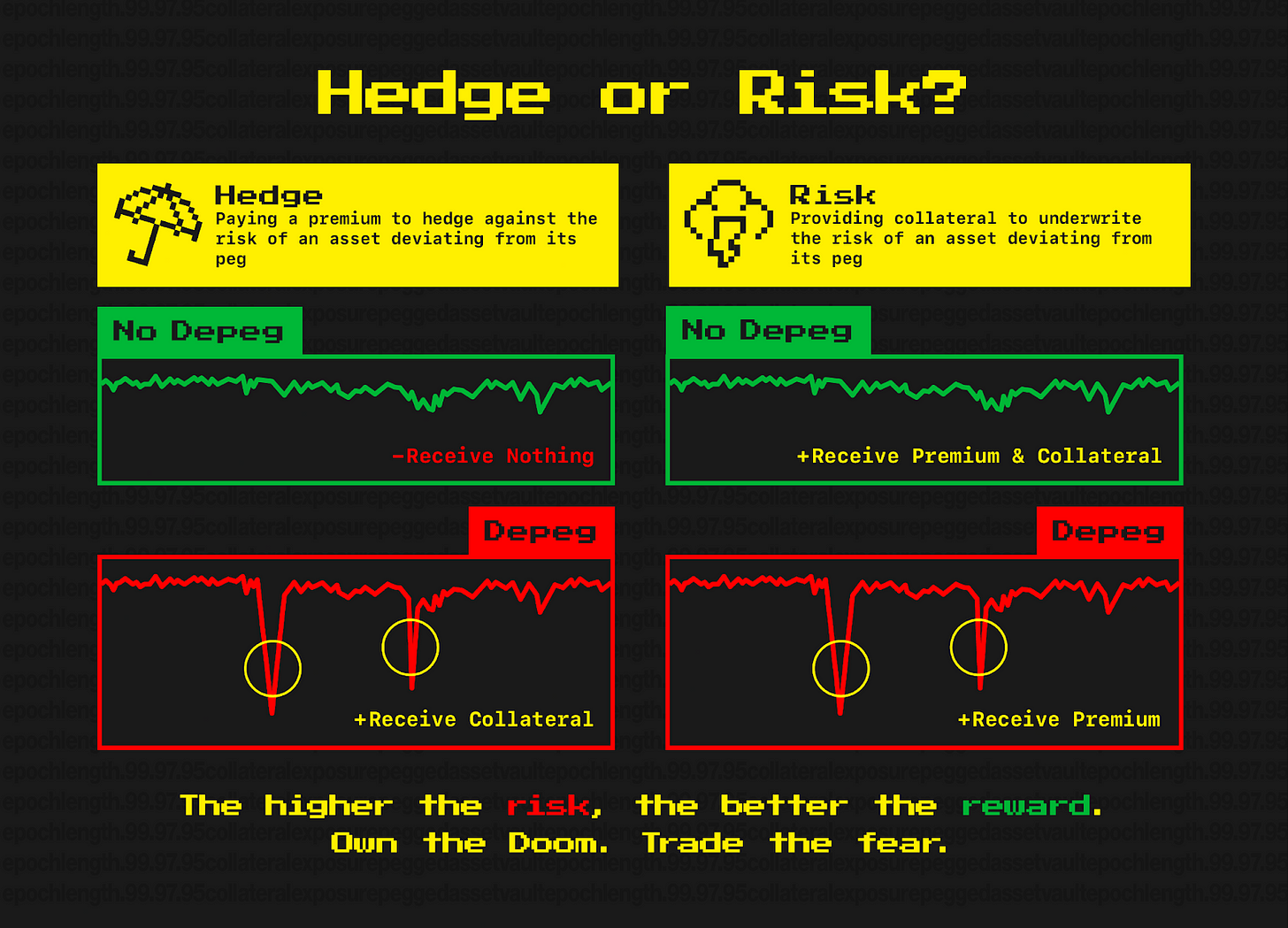

Most crypto investors keep a portion of their portfolio in stablecoins. It turns out that stablecoins may not always be so stable which means protecting against a depeg is another strategy to consider in the investor toolbox.

Holding different stablecoins between USDC, USDT and DAI is the first thing to consider. Alternatively, you can opt for a protocol like Y2K finance that lets you buy a kind of “insurance” against a potential depeg. Should an eventual stablecoin depeg occur, investors are paid a set sum of collateral from underwriters betting against a depeg.

See Bankless’ previous article on How to Protect Against Stablecoin Blowups with Y2K Finance.

#3 Diversifying your wallet custody

“Not your keys, not your crypto” is an industry mantra that any crypto investor should pay heed to.

If you have to keep your crypto on a centralized custodian, use many centralized custodians. Should you own your crypto on an offline, cold wallet, it doesn’t hurt to diversify among more than one set of crypto wallets, especially after the Ledger wallet drama last month reminded us that even hardware cold wallets are never 100% safe.

Putting all of your eggs in one basket is always a recipe for disaster.

Alternatively, investors can opt for a multisig smart-contract wallet like Gnosis Safe. Safe distributes the ownership of the crypto wallet by splitting up the private key into different pieces, kind of like what Voldemort did with his soul. Without every private key signing off on a transaction, the funds in the multisig wallet cannot be moved.

See Bankless’ previous article on How to Evaluate the Safety of Your Crypto Wallet Custody.

#4 Hedge your exposure with DeFi options

[ad_2]

Read More: www.bankless.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  USDS

USDS  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  Hedera

Hedera  Litecoin

Litecoin  WETH

WETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Wrapped eETH

Wrapped eETH  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Uniswap

Uniswap  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  Cronos

Cronos  sUSDS

sUSDS  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic