[ad_1]

Dear Bankless Nation,

NFT marketplace competition may be the hot topic stealing most headlines today, but there is plenty of under-the-radar experimentation happening in the world of NFT DeFi.

This week, we dig into some young, promising opportunities in the nascent sector.

– Bankless team

Bankless Writer: William M. Peaster

“NFTfi,” the blending of DeFi solutions with NFT use cases, is the fastest-growing area of the cryptoeconomy right now.

With so many projects already available to explore in this scene, it can be dizzying figuring out where to start. This Bankless tactic curates five under-the-radar opps that are compelling and straightforward for NFTfi newcomers.

Right now, the total value locked (TVL) in DeFi is ~$49B, and the market cap of the NFT space is over $15B.

This means DeFi and the NFT ecosystem are handily the largest sectors in the cryptoeconomy today. However, these sectors are increasingly intersecting and blurring, giving rise to the category “NFTfi” — i.e., projects providing services at the crossroads of DeFi and NFTs.

Of course, NFTs are unique digital assets that represent ownership of a specific piece of content, while DeFi is all about creating decentralized and open financial products. When you combine the two, you get a brave new world of bleeding-edge financial opportunities for NFT holders.

These opps come in a range of different forms, from collateralizing NFTs for loans to yield farming with idle NFTs on liquidity protocols. Some of the more recognizable NFTfi categories and projects that are creating these sorts of opps today include:

But let’s say you’re a newcomer to NFTfi and you find this all very interesting but you’re not sure where to start. In this case, you’ll want to begin with straightforward opps that are relatively simple to use and don’t require having to track a bunch of information on an ongoing basis.

I watch the NFTfi scene closely in the course of my research at Metaversal, so I’ve been curating a list of these sorts of simpler opps lately. Today I’ve got a handful of cool ones to share with you.

Of course, treat these as early experiments as most are quite new. If you do try any, never deposit more crypto or NFTs than you can afford to lose. With a “safety first” approach, here are 5 fresh and under-the-radar opps you might consider as potential starting points for your first forays into NFTfi.

App | Docs | Twitter | Discord | Audit

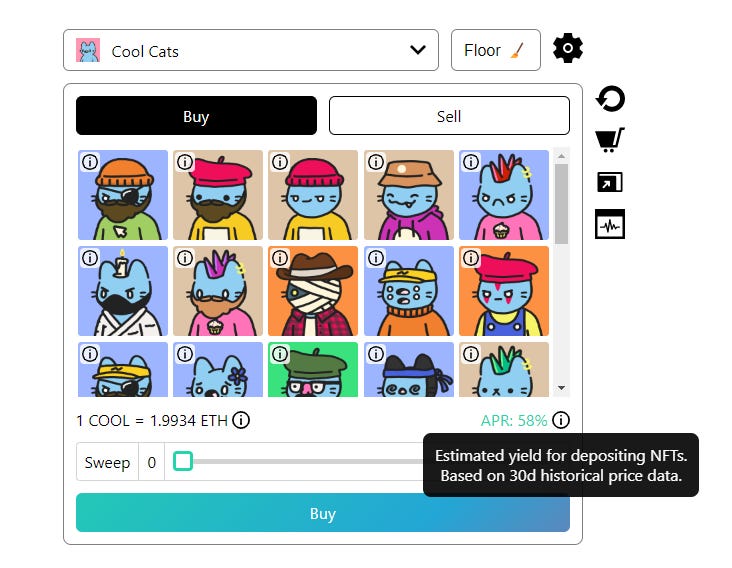

Caviar is an NFT AMM protocol for trading NFTs. It supports NFT fractionalization via ERC20s and also offers a unique “desirability classifier” system to organize NFT collections into sub-pools according to desirability scores. As such, each Caviar master pool has multiple independent price curves to account for an entire NFT collection’s liquidity. With this sub-pool system, the protocol aims to increase liquidity for rarer NFTs and incentivize trading activity for liquidity providers (LPs).

LPs on Caviar earn yield from a 1% fee that’s charged on every Caviar NFT swap. As more people trade through a given pool, that pool’s LPs earn more yield accordingly. The strat here, then, is LPing with ETH and NFTs in an active Caviar pool to profit from trading activity over time. For example, as you can see in the screenshot below, Cool Cats LPs on Caviar are currently earning 58% APR as based on the past 30 days of trading activity.

App | Docs | Twitter | Discord | Audit

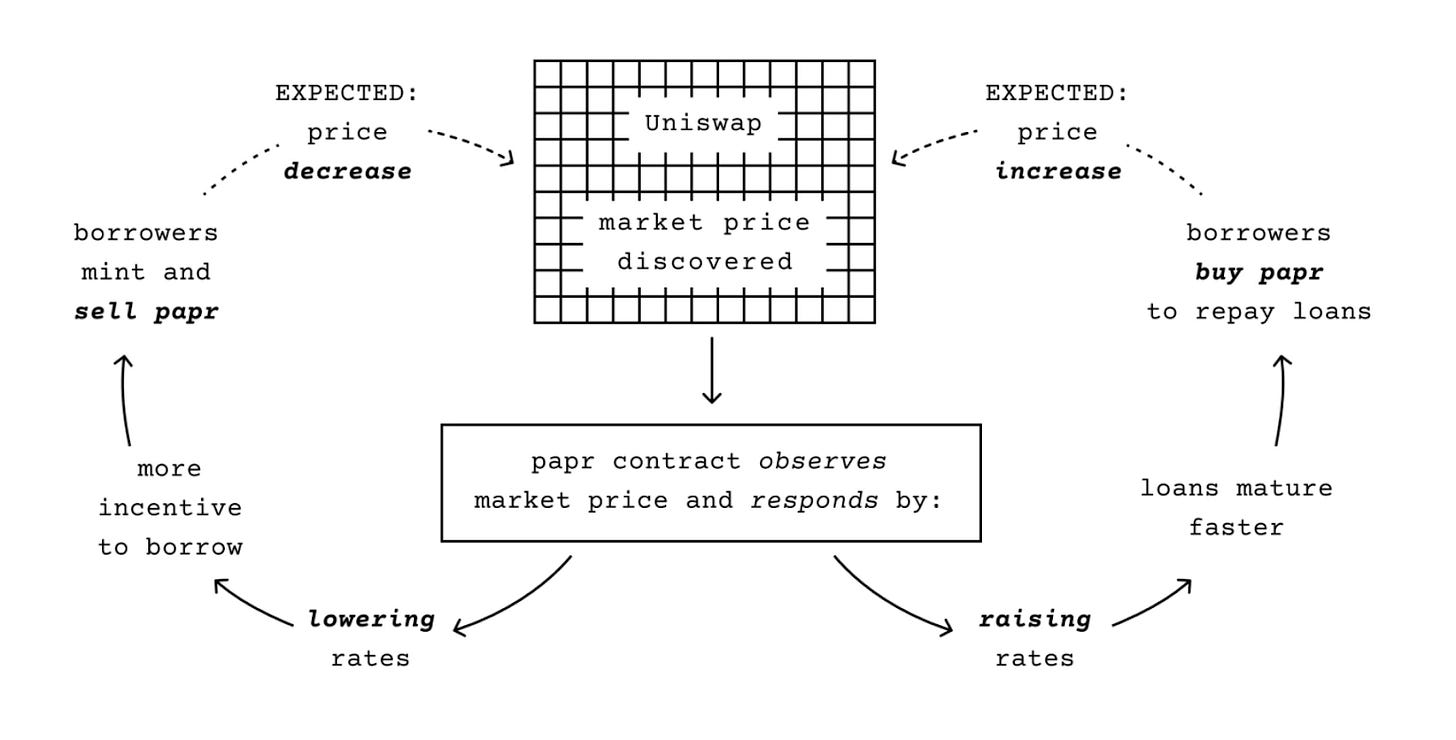

Created by Backed and inspired by Squeeth, Papr is a new type of NFT lending protocol that is designed to be flexible, resilient, and usable without lockup periods. This new approach centers around papr (“Perpetual APR”) tokens, which are mintable by borrowers upon sending NFTs as collateral to a papr controller smart contract. Borrowers can then sell these tokens on a DEX like Uniswap as needed, and this market activity creates a constant feedback loop between the papr trading price and the protocol’s interest rates.

A papr token offers holders and LPs a low-maintenance, “buy and hold” way to get exposure to multiple NFT collections and loans at once, as it offers the potential for interest in the form of its feedback-based price appreciation system. For instance, the first such token, $paprMEME, offers exposure to loans across 10 collections including Cool Cats, Forgotten Runes Wizard’s Cult, and Mfers.

App | Docs | Twitter | Discord | Audit

insrt finance is an NFT protocol for set-and-forget yield strategies, and its first category of product is called ShardVaults. Described as “fractional NFT spot exposure combined with passive yield farming,” these vaults offer low-priced ownership of bluechip NFTs via Shards, which are NFTs that represent fractional ownership of a ShardVault’s base NFT, e.g. a Bored Ape. Then the base NFT itself is put to work in NFTfi, generating yield for that NFT’s constituent Shard holders. For instance, insrt’s first ShardVaults (for CryptoPunk #9620 and BAYC #1369) are both generating their Shard holders over 15% APR right now.

ShardVaults #1, #2, and #3 have been fully minted out already, so until more vaults are rolled out the only way to get exposure to these initial NFT-based yield opps is to acquire Shards on a secondary marketplace like OpenSea. If you do, then you’ll automatically start raking in passive yield from the underlying NFT’s deployment.

Immutable is the preferred developer platform for building & scaling web3 games. Mint millions of assets for free, with frictionless gaming experiences, and increased liquidity through our Global Orderbook. Be part of the future with Gods Unchained, Guild of Guardians, Illuvium, and many more groundbreaking games.

App | Docs | Twitter | Discord | Audit

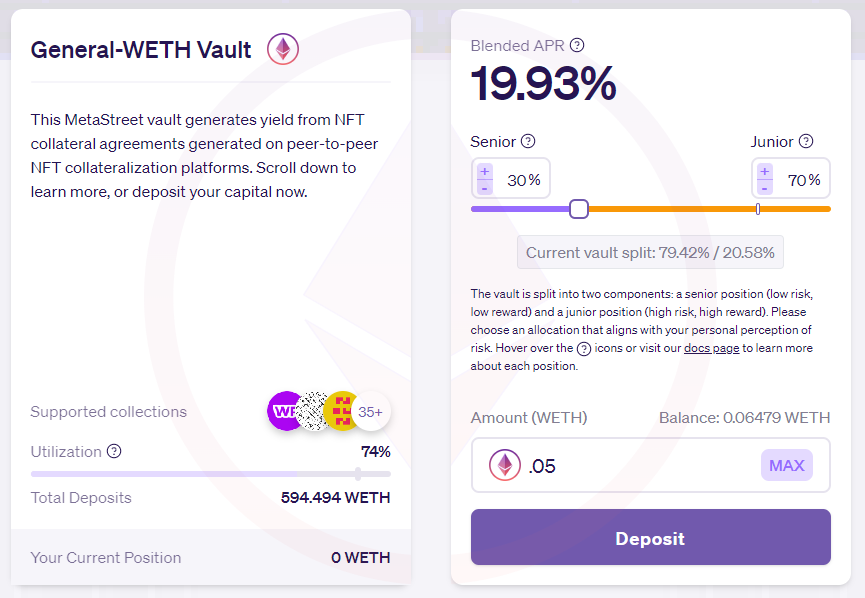

MetaStreet is a decentralized interest rate protocol for the metaverse. Its initial flagship products are its Capital Vaults, which let people deposit ETH, DAI, and later other crypto to earn from NFT-based vault strategies. Specifically, the Capital Vaults use these deposited funds to acquire P2P NFT-based promissory notes facilitated via lending projects like nftfi.com, and these notes provide yield via interest payments and liquidations. In this sense, you can think of MetaStreet’s Capital Vaults as an aggregator of NFT lending side liquidity.

Here, the idea is depositing into one of MetaStreet’s Capital Vaults for passive earnings. Since depositors can choose how much of their funds are split between senior (higher-risk) and junior (lower-risk) vault positions, how much APR you earn depends on how you blend your exposure. For instance, a 30/70 senior/junior split through the General-WETH Vault would generate ~20% APR at the moment.

App | Docs | Twitter | Discord | Audit

Hook is a decentralized NFT derivatives protocol that specializes in European-style call options, which allow people to speculate on the price of an NFT during a specific timeframe without having to fork over the full asking price for said NFT. To go deeper on the basic nuances here, check out this guide I wrote on Hook last year. In simple terms, though, Hook lets NFT holders earn premiums on their NFTs or sell them at optimal prices while offering traders the opportunity to earn from speculative longs or shorts.

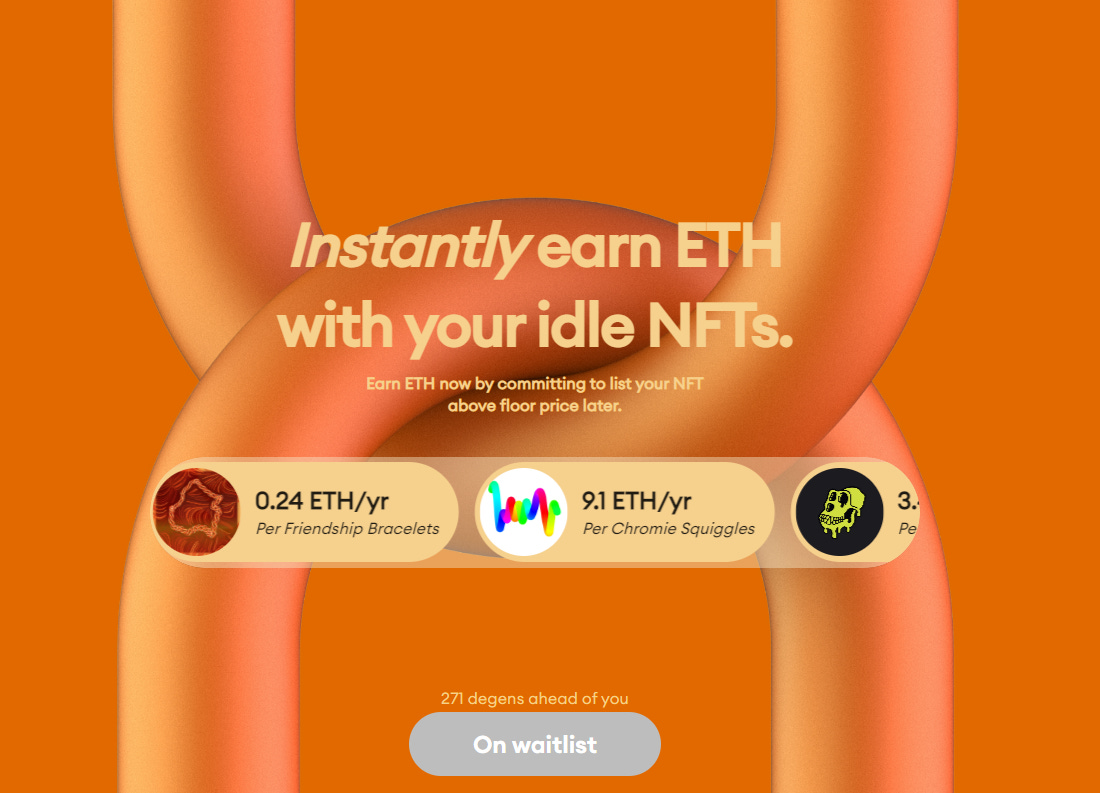

Hook’s latest product is Hook Earn, which is powered by the protocol’s call options under the hood. This new service allows NFT owners to start getting instant earnings on their idle NFTs so long as they agree to list said NFTs for a particular price at a particular future date. If there’s no purchase on that target date, you get to keep the NFT and can redeposit it into the Earn system. If an NFT sells for higher than its listing price (which is always above a collection’s floor price), then the trader involved earns the spread. Accordingly, the “trader is paying the NFT holder upfront for these future potential earnings,” Hook has explained. Note, too, that Hook Earn is brand new so there’s still a waitlist while liquidity is accruing. You can sign up for early access on the project’s website.

Last week, we released a conversation we had with Eliezer Yudkowsky. It blew up (and inadvertently bummed Elon out).

The good news is that we’re just getting started. We have TONS more incredible pod content on the horizon.

When you join Bankless Premium, you get early (ad-free!) access to every pod we release, along with special debrief episodes where we dive even deeper into the discussions everyone else hears.

Want in?

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

[ad_2]

Read More: newsletter.banklesshq.com

Be The First To Listen

Be The First To Listen

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  USDS

USDS  Toncoin

Toncoin  Shiba Inu

Shiba Inu  WhiteBIT Coin

WhiteBIT Coin  Hedera

Hedera  Litecoin

Litecoin  WETH

WETH  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Uniswap

Uniswap  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Bittensor

Bittensor  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Cronos

Cronos  Internet Computer

Internet Computer  sUSDS

sUSDS  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic