Aptos’s APT native token just broke all-time highs today after mounting an impressive revenge run that powered through last week’s downturn.

As more capital flocks into its DeFi ecosystem, several promising projects are catching fire. Many of them are also offering their own opportunities, such as yield, points programs, or potential airdrops

Airdrop Hunter | Bankless

Join the exclusive airdrop hunting experience on Bankless to find the best opportunities and frontrun the opposition.

Today, let’s take a look at five top projects and see what makes these protocols stand out, highlighting how users could capitalize on the opportunities that come with them. Let’s dive in!

Thala Finance

Thala Finance

Thala leads Aptos’s TVL with a DeFi suite featuring a stablecoin, DEX, and liquid staking.

The yield-bearing Move Dollar (MOD) can be mintable against USDC from LayerZero or Wormhole and used in Thala Swap or across the ecosystem for added yield. Thala’s liquid staking and MOD pairs offer high-yield opportunities in stable pools. Locking THL for veTHL also enhances rewards, fueling a classic DeFi flywheel. Thala also provides a launchpad outside these core projects, though they’ve only launched their native token.

Further, Thala and ![]() Aptos L1Aptos is a Layer-1 blockchain with high scalability and institutional backing.View Profile” class=”stubHighlight”>Aptos Foundation launched a $1M fund (scaling to $5M) for Aptos DeFi development. One of Thala’s team members recently teased upcoming AI and DeFi project launches from this Thala Foundry initiative, slated for Q2-Q3.

Aptos L1Aptos is a Layer-1 blockchain with high scalability and institutional backing.View Profile” class=”stubHighlight”>Aptos Foundation launched a $1M fund (scaling to $5M) for Aptos DeFi development. One of Thala’s team members recently teased upcoming AI and DeFi project launches from this Thala Foundry initiative, slated for Q2-Q3.

He also noted the team’s strong inspiration from Celestia Airdrops — words that certainly spark the imagination.

Where’s the Opportunity?

Thala’s breadth of products gives extensive opportunities with:

- APT: Deposit APT for Thala’s LST thAPT, then stake it to earn ~10% APR. Or, you can deposit a combination of both into their stable pool, earning ~18% APR with little risk.

- MOD: Keep some zUSDC from bridging with LayerZero, deposit zUSDC for MOD, and deposit both into their stable pool to earn ~60% APR!

- Stability Pool: Deposit into Thala’s Stability Pool to earn ~65% APR and back their lending borrowing vaults. This strategy is the most risky.

- THL: You can lock THL, Thala’s governance token, for veTHL, to receive rewards, and potentially even airdrops from projects that go through Thala’s Foundry program. Given what they said about TIA, this isn’t a stretch.

Overall, Thala has positioned itself as the center of DeFi on Aptos thanks to its holistic suite, strong hold on TVL, and supportive Foundry.

Aptin Finance

Aptin Finance

Aptin Finance, an Aptos lending/borrowing market, saw significant TVL growth this past month.

Aptin’s user-friendly dashboard allows earning and borrowing of stablecoins, APT, and ETH, with yields up around 25%. Further, participating in their markets will give you points for their upcoming token, slated for Q1. A look at Aptin’s roadmap shows they have a pulse of this cycle’s headwinds, with integrations and products targeting the Bitcoin/BRC20 ecosystem as focuses for Q2 and Q3. Further, they also have omni-chain lending as a goal, which could open their market to extensive amounts of new liquidity.

Where’s the Opportunity?

As mentioned above, the best opportunities from Aptin currently come from two paths:

- Lending/Borrowing: Earn ~25% and ~20% yields on bridged zUSDC and ETH, or borrow against these assets at ~8% and ~1%.

- Points Program: You’ll also earn points for their token launch by lending and borrowing. Refer others to their platform, and you’ll earn even more!

Aptin’s lending and borrowing markets, ambitious roadmap, and recent growth could help it become a key player in Aptos’s ecosystem. Focusing on a particular aim rather than trying to be a jack of all trades, plus targeting the BTC ecosystem, could do wonders for its liquidity growth. They have to execute on this, though, and even before that, retain interest past their token drop.

Amnis Finance

Amnis Finance

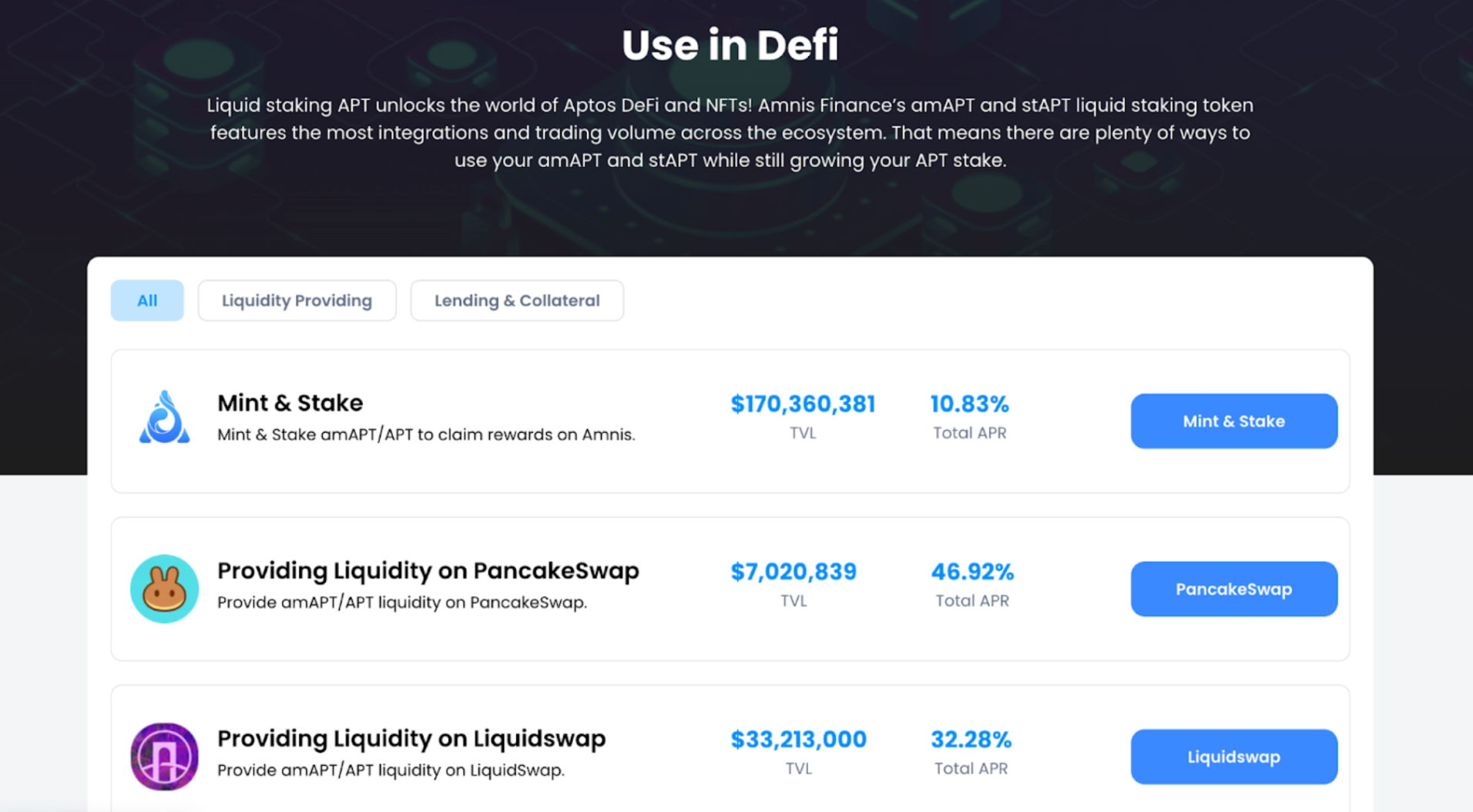

Amnis introduces liquid staking to Aptos, offering high yields with maintained liquidity.

It innovates by creating YT tokens through yield tokenization, splitting interest-earning assets (stAPT) into PT for the principal and YT for the earnings. YT tokens allow holders to collect their entire interest without fees and redeem their full initial investment at maturity.

Where’s the Opportunity?

Opportunities for Amnis come from a couple areas:

- Staking APT: The most straightforward opportunity Amnis offers is staking your APT with them and earning 11%.

- LST in DeFi: If you want to go further, a series of yield opportunities to use their LST in other DeFi protocols around the ecosystem, some of which offer up to ~45% APR!

Amnis’s liquid staking offers a higher base yield than other providers. It allows for further increases through protocols within its ecosystem. Amnis faces competition, though, as liquid staking is a standard protocol feature.

Aries Market

Aries Market

Aries leads Aptos’s leverage trading with derivatives and a comprehensive trading platform.

It also boasts an AMM swap, bridging platform, and lending and borrowing markets to earn yield on assets like USDC, USDT, and ETH. As far as trading, they currently support ETH and APT with plans to scale up their offerings soon.

Where’s the Opportunity?

Beyond trading, the opportunities in Aries come from its incentive program and the yield from its lending/borrowing markets.

- Yield: Lending yields on stablecoins, boosted by their current incentive program, currently sit at ~20%, and borrowing rates for USDC rest at ~1-2%. This differential lends itself to some nice strategies.

- Points Program: Additionally, Aries announced its points program in January, which rewards users for lending, borrowing, and, of course, referring others.

Aries is starting strong as the current leader of Aptos’s derivatives markets. Boosted by its ongoing incentive program and low borrowing fees, the protocol could continue to stand out and grow. But, given the early stages of Aptos’s ecosystem, this may not be enough for Aries to stay ahead, especially as projects connected to Thala Foundry launch.

Ondo Finance

Ondo Finance

Besides showing incredible strength during the recent downturn, Ondo Finance offers exposure to Aptos’s ecosystem.

The Blackrock-linked RWA platform will launch its tokenized U.S. Treasury-backed products USDY on Aptos. Thala is the deepest integration here. USDY will be added to the AMM’s pools and whitelisted as collateral for their MOD stablecoin. Further, considering Ondo’s announcement of its Global Markets, which will tokenize securities, we could see this bringing even further volume to the chains it supports. Further, a massive, RWA-centered announcement from Aptos looks poised to come in April after their team met with three of the world’s largest asset managers — something people expect to be a huge catalyst for them.

Where’s the Opportunity?

Many opportunities lie within Ondo — holding ONDO, farming its points program, and using USDY in strategies. Here’s how to do these:

- ONDO: ONDO, available on exchanges like Coinbase and Bybit, offers a straightforward entry into Aptos’s ecosystem, as well as by Sui, Solana, and Ethereum, where Ondo also deployed USDY.

- Points Program: Providing liquidity for USDY onchain, holding ONDO on Ethereum, and even missing out on past yield opportunities for stables all earn you points for future redemption. However, ONDO tokens will not be unlocked til Jan 2025, so you’ll have to wait for quite some time.

- USDY in DeFi: Yield opportunities also abound for USDY onchain, and since the token is pegged to treasuries, it proves to be more stable than most.

At the intersection of DeFi and RWAs, Ondo Finance presents the arguably safest bet for exposure to Aptos’s ecosystem backed by titans like Founder’s Fund, DCG, the LAO, and Tiger Global.

As Aptos evolves, Thala, Aptin, Amnis, Aries, and Ondo stand out as promising players to impact how DeFi forms on the chain, and all present opportunities in staking, yield, and real-world asset integration.

These initiatives make Aptos’s ecosystem an exciting place in the Alt-L1 world. With the network currently pushing past its all-time high, there’s likely going to be more attention flocking to its DeFi ecosystem, and in crypto, where there are eyeballs, there are opportunities.

What’s Going On With Aptos? on Bankless

We unpack the VC-adored L1 blockchain’s recent token pump.

Read More: www.bankless.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  LEO Token

LEO Token  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  Litecoin

Litecoin  WETH

WETH  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  Aptos

Aptos  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  Ondo

Ondo  Ethereum Classic

Ethereum Classic