Following a major slump in the market, the crypto-verse witnessed an array of assets headed toward recovery. While Bitcoin [BTC] reclaimed the $20K zone, Ethereum [ETH] was seen pocketing significant gains. Amidst all of this, it was brought to light that there was over $1.12 billion in liquidations on mostly short trades. It should be noted that over the last 24 hours 156,040 traders were liquidated.

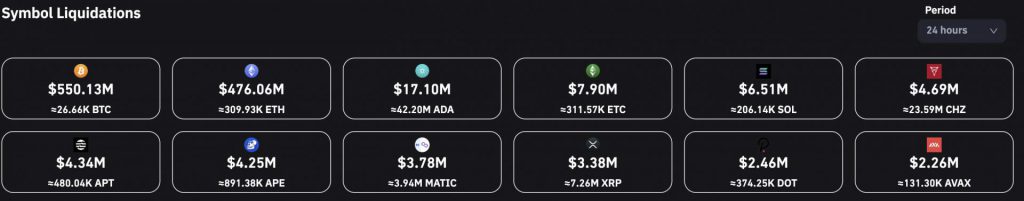

Bitcoin and Ethereum were leading the liquidation with a whopping $550.13 million and $476.06 million. Cardano [ADA] and Ethereum Classic [ETC] took over the next two ranks with $17.10 million and $7.90 million.

While these liquidations ticked off a short squeeze, an array of crypto assets recorded prominent surges. Ethereum was clearly leading the market with a 14.15 percent daily surge. Thanks to this, the altcoin rose to a high of $1,535, at press time.

Cardano as well as Ethereum Classic weren’t far behind. Both these assets were pocketing double-digit gains. Notably, the liquidations represent a three-month high. According to the image below, a recent high level of liquidation(longs in this case) was reached on August 19, 2022.

FTX and Okex record the most liquidations

When an exchange forcibly terminates a trader’s leveraged position as a result of a partial or complete loss of the trader’s initial margin, this is known as liquidation. This usually occurs when a trader is unable to fulfill the margin requirements for a leveraged position.

Exchanges that saw the most liquidations were FTX, Okex as well as Binance. All these exchanges recorded increased short liquidations. Over the last 24 hours, FTX recorded liquidations worth $842.75 million and Okex was at $91.16 million.

Binance, the world’s largest crypto exchange in trading volume, saw liquidations worth $71.30 million. While most exchanges on the list witnessed prominent short rates, Bitfinex exhibited a 92.51 percent long rate.

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Hedera

Hedera  Litecoin

Litecoin  Pepe

Pepe  Uniswap

Uniswap  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Bittensor

Bittensor  Render

Render  Filecoin

Filecoin  Algorand

Algorand  Arbitrum

Arbitrum  Dai

Dai  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Cosmos Hub

Cosmos Hub  Stacks

Stacks  MANTRA

MANTRA